WORLDWIDE: HEADLINES

Euro Zone Business Activity Contracted For Second Straight Month In Aug – Flash PMI

Business activity in the euro zone contracted for a second straight month in August as the cost of living crisis forced consumers to cut spending while supply constraints also hurt manufacturers, a survey showed on Tuesday.

S&P Global’s flash Composite Purchasing Managers’ Index (PMI), seen as a good guide to overall economic health, fell to 49.2 in August from 49.9 in July, just above the median forecast in a Reuters poll for a bigger drop to 49.0.

A reading below 50 indicates a contraction and August’s preliminary estimate was the lowest since February 2021.

“The latest PMI data for the euro zone point to an economy in contraction during the third quarter of the year,” said Andrew Harker, economics director at S&P Global.

A Reuters poll last month put growth at 0.2% this quarter.

Full coverage: REUTERS

China Says International Services Trade Faces Challenges

China is facing growing challenges in international services trade as COVID-19 outbreaks curb mobility and softening external demand weighs on firms’ operating outlooks, the country’s vice commerce minister said on Tuesday.

Local COVID-19 outbreaks have restricted cross-border movement, hurting travel, construction and exhibitions, said Vice Commerce Minister Sheng Qiuping at a press conference.

“Some services trade enterprises are facing challenges such as insufficient orders and rising costs, and their business expectations are unstable,” Sheng said ahead of the upcoming China International Fair for Trade in Services (CIFTIS). “In particular, small and medium-sized enterprises, which have relatively weak abilities to ward off risks, are facing greater pressure to survive.”

Amid a sluggish global economic recovery, he said China’s services trade faces risks of declining external demand.

Full coverage: REUTERS

WORLDWIDE: HEADLINES

Europe’s Energy Troubles Haunt Euro, Asian Shares

Asian shares were down for a seventh straight session on Tuesday after a renewed spike in European energy prices stoked fears of recession and pushed bond yields higher, while tipping the euro to 20-year lows.

European stocks looked set to follow Asian equities. EUROSTOXX 50 futures and FTSE futures were both off around 0.2% after sliding overnight.

Benchmark gas prices in the European Union surged 13% overnight to a record peak, having doubled in just a month to be 14 times higher than the average of the past decade.

Analysts at Citi warned inflation in Britain could top 18% if energy prices were not restrained.

Full coverage: REUTERS

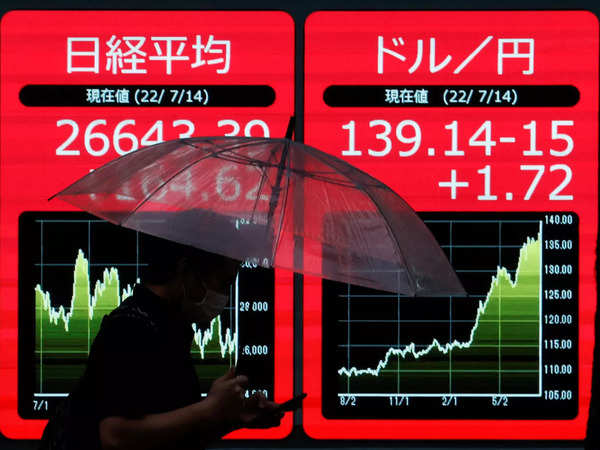

Euro Falls To Fresh Two-Decade Low, Dollar Exudes Strength

The euro dropped to a fresh two-decade trough on Tuesday as Europe was buffeted by concerns about energy supply and economic growth, while the dollar held firm against major peers, supported by safe-haven flows.

The euro hit $0.9909, its lowest since late 2002, and was last down 0.29% at $0.9914.

Russia will halt natural gas supplies to Europe via the Nord Stream 1 pipeline for three days at the end of the month, the latest reminder of the precarious state of the continent’s energy supply.

Heatwaves in the continent have already put a strain on energy supply and worries are growing that any disruption during the winter months could be devastating for business activity.

Full coverage: REUTERS

Oil Climbs As Saudi Arabia Warns Of OPEC Output Cuts

Oil rose on Tuesday as renewed concerns over tight supply dominated market sentiment after Saudi Arabia warned that the major oil producer could cut output to correct a recent oil price decline.

Brent crude gained 42 cents, or 0.4%, to $96.90 a barrel by 0630 GMT, after a choppy session on Monday when they dropped by more than $4 before paring losses to trade near flat. It advanced by $1 a barrel in early Asia trading hours.

U.S. West Texas Intermediate crude futures rose 40 cents, or 0.4%, to $90.76 a barrel.

The benchmarks are down about 12% and 8% this month, respectively, amid fears about a global recession and fuel demand.

Full coverage: REUTERS