WORLDWIDE: HEADLINES

BOJ’s Kuroda says stock boom reflects economic optimism, defends ETF scheme

TOKYO – Bank of Japan Governor Haruhiko Kuroda said on Tuesday the recent stock price rally reflected market optimism over the global economic outlook, brushing aside views its ultra-loose monetary policy was fuelling an asset price bubble.

Kuroda said the central bank would be vigilant for financial risks associated with prolonged easing, nodding to growing concern among some lawmakers that prolonged easing was sowing the seeds of a bubble.

But he stressed that it was premature to debate an exit from super-loose policy including the BOJ’s huge purchases and holdings of exchange-traded funds (ETF), as the coronavirus pandemic continues to ravage the economy.

“It’s likely to take significant time to achieve our price (inflation) target. As such, now is not the time to think about an exit including from our ETF buying,” Kuroda told parliament.

The BOJ has unveiled a plan to review its policy tools, including its ETF-buying programme, in March to make it more sustainable as the pandemic forces it to maintain its stimulus for a prolonged period.

The plan reflects a growing concern among policymakers over the rising cost of extended easing. Some analysts also criticize the BOJ for continuing its huge ETF buying at a time Tokyo stock prices have set new highs.

Kuroda said it was hard to predict whether stock markets were in a bubble.

“Optimism over the global economic outlook and steady vaccine rollouts may be behind the recent surge in stock prices,” Kuroda said.

“But the global outlook remains highly uncertain,” he said, adding that risks to Japan’s economy remained skewed to the downside.

Full coverage: REUTERS

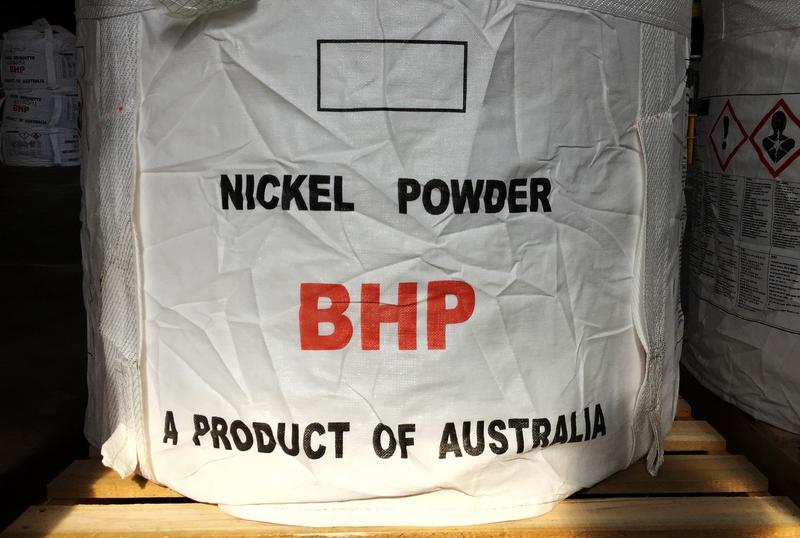

BHP sees robust China demand, declares dividend bonanza

MELBOURNE – BHP Group on Tuesday reported its best first-half profit in seven years and declared a record interim dividend, as top metals user China’s strong appetite for iron ore to support its infrastructure push kept prices elevated.

China’s reliance on commodity-intensive stimulus measures to sustain economic growth has sent prices of the steel making ingredient to multi-year highs, while the COVID-19 vaccination push has brightened outlook for global trade this year.

The world’s largest listed miner said in a statement it expects a continuation of strong Chinese demand in 2021, and recovery in the rest of the world’s global crude steel production.

“It’s a pretty solid result,” said portfolio manager Andy Forster of Argo Investments.

“Relative to expectations, it looked pretty good, strong cash flows and dividend, projects operationally performing well,” he said. “Strong iron ore and copper should set it up for a pretty good second half as well.”

BHP is the first of its Australian peers to report this week, with all expected to cash in on sky high prices for iron ore. Rio Tinto reports on Wednesday and Fortescue on Thursday. Last month, BHP forecast record annual iron ore output.

The company declared an interim dividend of $1.01 per share, up from last year’s payout of $0.65 per share.

Its underlying profit from continuing operations for the six months ended Dec. 31 rose to $6.04 billion from $5.19 billion last year. It missed a consensus of $6.33 billion, however, from 17 analysts compiled by research firm Vuma Financial.

Full coverage: REUTERS

WORLDWIDE: FINANCE / MARKETS

Asia sets up global stocks for extended bull run on economic optimism

TOKYO – Asian shares advanced on Tuesday, putting world equities on course to extend their bull run for a 12th consecutive session as optimism about the global economic recovery and expectations of low interest rates drive investments into riskier assets.

Oil prices soared to a 13-month high as a deep freeze due to a severe snow storm in the United States not only boosted power demand but also threatened oil production in Texas.

MSCI’s broadest index of Asia-Pacific shares outside Japan ticked up 0.45% while Japan’s Nikkei rose 0.4% to a 30-year high.

In Hong Kong, the Hang Seng Index surged 1.79% to hit a 32-month high in its first trading session since Thursday following the Lunar New Year holidays.

Mainland Chinese markets will remain closed for the holidays until Thursday while Wall Street was also shut on Monday.

Ord Minnett advisor John Milroy said while share markets were positive investors were becoming wary of the future risk of inflation due to central bank and government stimulus programmes in place around the world.

“There is a clear sense with rates staying low for some time yet and investor appetite for equities staying strong we will likely see markets hold up for some time yet,” Milroy told Reuters.

“Gaining traction is the thought that inflation could rise much faster and sooner than the Fed is currently thinking. Then if they do raise rates to combat it what happens to equity markets and of course bond markets.”

The bullish view on the economy lifted bond yields, with the 10-year U.S. Treasuries gaining 5 basis points to 1.245% in early Asian trade, its highest since late March.

Full coverage: REUTERS

Oil prices climb as deep freeze shuts U.S. oil wells, curbs refineries

SINGAPORE – Oil prices rose on Tuesday as a cold front shut wells and refineries in Texas, the biggest crude producing state in the United States, the world’s biggest oil producer.

Prices also gained as Yemen’s Iran-aligned Houthi group said it struck airports in Saudi Arabia with drones, raising supply concerns in the world’s biggest oil exporter, and on optimism for a global economic recovery amid accelerated COVID-19 vaccine rollouts.

Brent crude was up 11 cents, or 0.2%, at $63.41 a barrel at 0144 GMT, after rising to its highest since January 2020 in the previous session.

U.S. West Texas Intermediate (WTI) crude futures gained 62 cents, or about 1%, to $60.09 a barrel. WTI did not settle on Monday because of a U.S. federal holiday. Prices will settle at the close of trading on Tuesday.

“The unexpected U.S. supply disruption provides another short term price recovery bridge that has likely taken oil prices to a level where markets were eventually heading but just a little bit quicker than expected,” Stephen Innes, chief global markets strategist at Axi said in a note on Tuesday.

The cold weather in the U.S. halted Texas oil wells and refineries on Monday and forced restrictions on natural gas and crude pipeline operators.

The rare deep freeze prompted the state’s electric power suppliers to impose rotating blackouts, leaving nearly 3 million homes and businesses without power.

Texas produces roughly 4.6 million barrels of oil per day and is home to 31 refineries, the most of any U.S. state, according to Energy Information Administration data, including some of the country’s largest.

Full coverage: REUTERS

Dollar in doldrums as recovery optimism thrives

SINGAPORE – The U.S. dollar was pinned down on Tuesday, as vaccine optimism boosted the British pound to an almost three-year high, while rising oil prices and buoyant expectations for global recovery supported commodity and trade-exposed currencies.

In trade thinned by Lunar New Year holidays in China and Monday’s U.S. holiday, the positive mood also weighed on the safe-haven yen which made a one-week low on the dollar overnight and fell to more than two-year lows on the euro and the Aussie.

The U.S. dollar index, which measures the dollar against a basket of six major currencies, sat at 90.351, not far above a two-week low it struck last Wednesday.

The Chinese yuan, a favoured vehicle for playing the dollar’s weakness in Asia, was on the brink of strengthening past 6.4 per dollar for the first time since mid-2018 and last stood at 6.4033 in offshore trade.

The risk-sensitive Australian dollar held near Monday’s one-month high at $0.7785.

“The dollar tends to underperform when you see this broad positive sentiment in markets,” said Rodrigo Catril, senior currency strategist at National Australia Bank in Sydney.

“There are also inflationary pressures particularly coming from energy prices,” he said, which is pushing up nominal yields – adding another weight on the yen as that can attract flows from Japan – but keeping real returns on Treasuries steady.

Sterling, which broke past $1.39 for the first time in almost three years on Monday, held at $1.3912. It also held steady at 87.15 pence per euro, its highest since May 2020.

Sterling has gained as much as 2.5% on the dollar in less than two weeks as the aggressive rollout of Britain’s COVID-19 vaccination programme has raised expectations its economy will be able to recover more swiftly than European peers’.

Full coverage: REUTERS