ZURICH, Oct 7 (Reuters) – Credit Suisse (CSGN.S) will buy back up to 3 billion Swiss francs ($3 billion) of debt, the embattled Swiss bank said on Friday, making a show of strength as it seeks to reassure investors after a tumultuous week.

The move trims the Swiss bank’s debt burden and is an attempt to bolster confidence after steep falls in its stock price and bonds. Unsubstantiated rumours that its future was in doubt have swirled on social media amid concern it may need to raise billions of francs in fresh capital.

Full coverage: REUTERS

UK House Prices Fall Again As Higher Borrowing Costs Weigh-Halifax

LONDON, Oct 7 (Reuters) – British house prices fell for the second time in three months in September in month-on-month terms and rising borrowing costs are likely to exert “more significant downward pressure” soon, mortgage lender Halifax said on Friday.

House prices fell by 0.1% from August, Halifax said. In annual terms, house prices were 9.9% higher, the slowest such increase since January.

Kim Kinnaird, director of Halifax mortgages, said a recent cut to a tax for home-buyers – part of finance minister Kwasi Kwarteng’s “mini-budget” – and the long-standing shortage of homes available to buy would help to support the market.

Full coverage: REUTERS

Japan’s Foreign Reserves Drop By Record On Market Shakeout, FX Intervention

TOKYO, Oct 7 (Reuters) – Japan’s foreign reserves fell by a record $54 billion in September, official data showed on Friday, as global market ructions dented the value of foreign bonds and prompted dollar-selling intervention to arrest a steep decline in the yen.

The reserves stood at $1.238 trillion at the end of September, the lowest amount since the end of March 2017, according to the Ministry of Finance data.

The data on Japan’s foreign reserves, the world’s second largest in size after China, came a week after separate MOF figures showed Tokyo spent up to a record 2.8 trillion yen ($19.32 billion) intervening in the market last month.

Full coverage: REUTERS

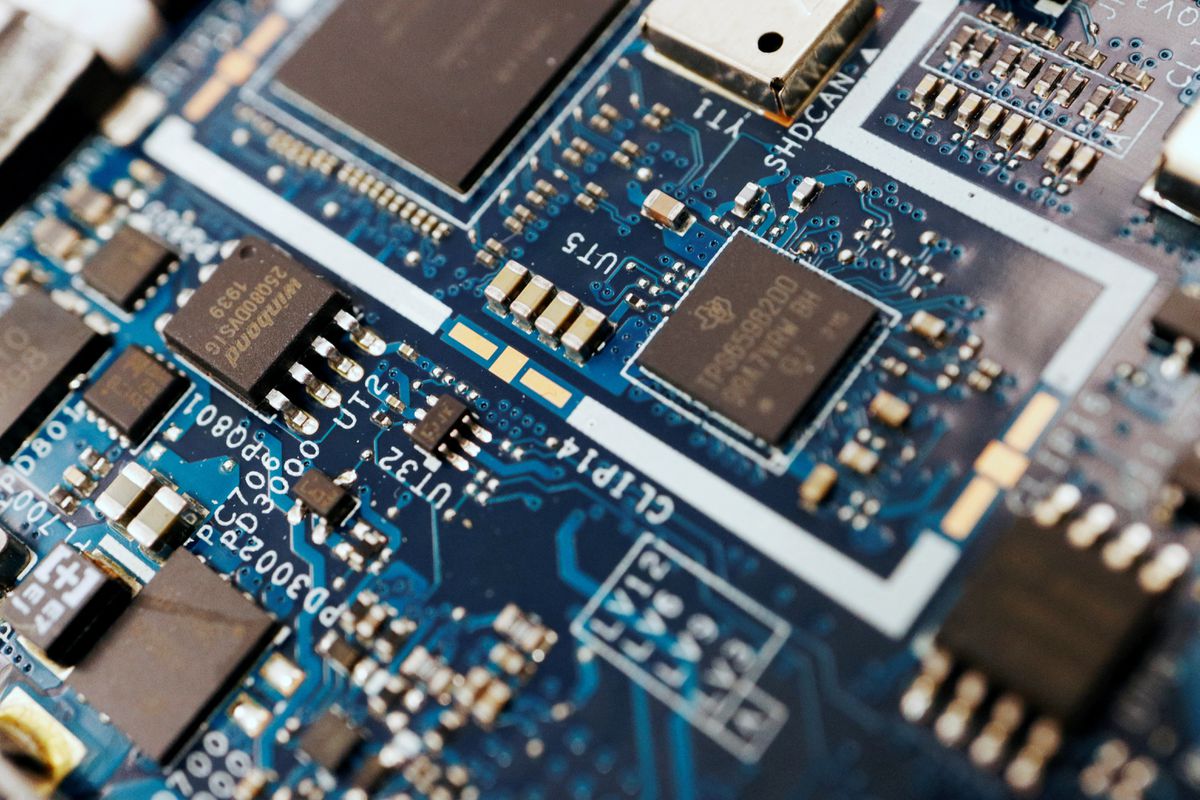

Analysis: Chip Industry Rethinks Taiwan Risk After Pelosi Visit But Options Limited

TAIPEI, Oct 7 (Reuters) – Chinese missiles flying over Taiwan and naval drills in the Strait in August that simulated a blockade by China have jolted the semiconductor industry into contemplating what once seemed a remote possibility: war over the major chip-producing island.

From drafting contingency plans to inquiring about manufacturing capacity outside Taiwan, some companies are now weighing how to respond if China attacks or restricts access to the democratic island, according to 15 semiconductor executives interviewed by Reuters.

Full coverage: REUTERS

Asian Stocks Retreat On Global Recession Angst; Tech Dives

TOKYO, Oct 7 (Reuters) – Asian stocks declined on Friday, extending a global equity slide to a third day, as investors fretted over recession risks amid signs of further aggressive central bank policy tightening and new signs of a deep semiconductor slump.

The dollar and Treasury yields remained elevated after multiple Federal Reserve officials continued to talk up additional rate hikes ahead of a crucial U.S. jobs report later in the day, while rising crude oil prices compounded concerns about prolonged inflation.

Full coverage: REUTERS