WORLDWIDE: HEADLINES

China Jan-Feb Industrial Output, Retail Sales, Investment Beat Forecasts

China’s factory output unexpectedly picked up pace in the first two months of the year while retail sales beat expectations, even though the country is grappling with a surge in COVID-19 cases, a property market downturn and heightened global uncertainties.

Industrial output rose 7.5% in January-February from a year earlier, the fastest pace since June 2021 and up from a 4.3% increase seen in December, official data showed on Tuesday. That compared with a 3.9% surge in a Reuters poll.

Retail sales in January-February grew 6.7% year-on-year amid rising demand during the Lunar New Year holidays, having increased 1.7% in December. The figure – also the quickest since June 2021 – beat expectations of a 3.0% increase in the poll.

Fixed asset investment rose 12.2% on year compared with the 5.0% increase tipped by the Reuters poll and 4.9% growth in 2021. The figure was the highest since July last year.

The unexpectedly strong performance of the world’s second largest economy in the new year came after China’s economy was losing momentum as a liquidity crunch in the property market and strict anti-virus measures hit consumer confidence and spending.

Premier Li Keqiang said on Friday that he is confident of hitting this year’s economic growth target of around 5.5% despite challenges including the war in Ukraine. Li also vowed to provide more policy support in the year.

China’s economic activity is normally impacted in January and February because of the week-long Lunar New Year holiday, which fell in February in 2022. Many factory workers stayed put during the holiday due to COVID control measures and kept factory floors humming.

In February, the country’s factory inflation eased to the slowest pace in eight months and consumer inflation rose 0.9%, pointing to cautious demand already hurt by strict anti-coronavirus measures.

Factory activity expanded slightly last month as new orders improved, purchasing managers’ surveys showed, pointing to some resilience in the economy.

Full coverage: REUTERS

Australia’s Central Bank Still Patient On Policy Despite Inflation Shock

Australia’s central bank remains prepared to be patient on raising interest rates as it waits for wage growth to pick up, though it warned a surge in commodity prices caused by the war in Ukraine would add to inflationary pressure.

Minutes of its March meeting released on Tuesday showed the Board of the Reserve Bank of Australia (RBA) was generally upbeat on the domestic outlook with labour market conditions the tightest since 2008.

However, the outlook for the world economy had been darkened by the conflict in Ukraine.

“The invasion had created additional uncertainty about the global outlook and was an adverse supply shock that would result in lower growth and higher inflation,” the minutes showed.

Yet Board members agreed it was too early to conclude that inflation would not again fall out of the 2-3% target band once supply pressures abated, and noted wage growth still lagged.

“The Board is prepared to be patient as it monitors how the various factors affecting inflation in Australia evolve,” it concluded.

The central bank kept interest rates at a record low of 0.1% as widely expected at the March meeting, though RBA Governor Philip Lowe did say it was plausible a first hike could come later this year should the economy strengthen as expected.

So far, economic activity has surprised with its resilience as household’s used extra saving built up over the pandemic to spend with abandon.

A wave of Omicron cases, the rising cost of living and massive flooding on the east coast have tested confidence, but not derailed the recovery.

The labour market has been particularly impressive, generating a record run of jobs that pushed unemployment to its lowest in 13 years at 4.2%.

RBA Governor Philip Lowe is keen to get unemployment under 4% for the first time since the 1970s and is prepared to keep rates low to deliver it and, hopefully, drive wages higher.

Full coverage: REUTERS

WORLDWIDE: FINANCE/BUSINESS

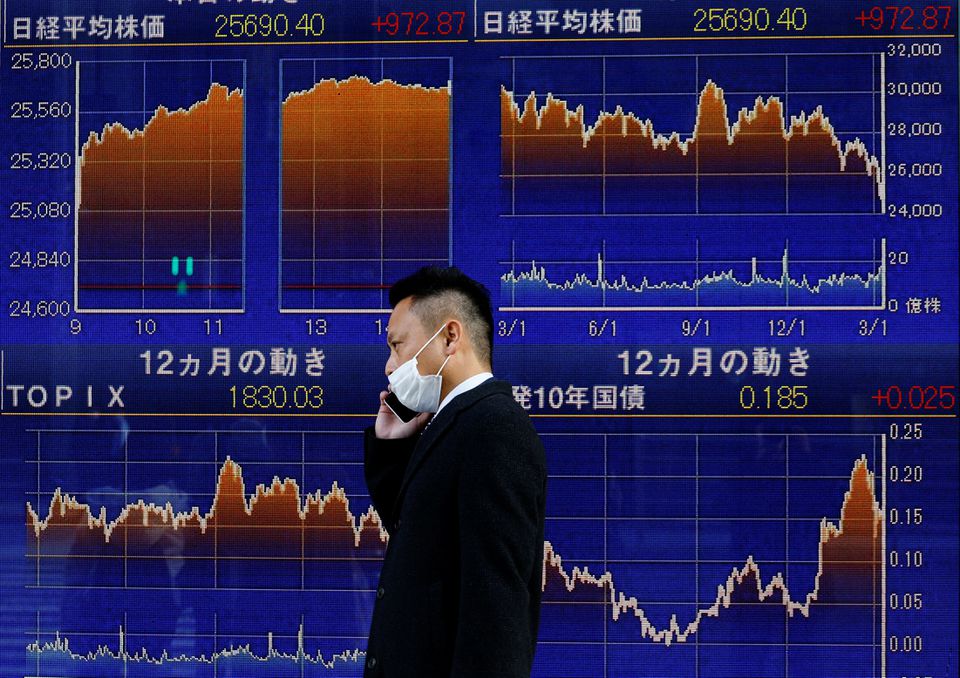

Asia Stocks Skid As Ukraine War, China’s COVID Surge Weigh

Asian stocks were in the red on Tuesday as surging COVID-19 cases in China hit the confidence of investors who are already worried about the Ukraine war and the first U.S. interest rate rise in three years, which could come this week.

MSCI’s broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) was down 1.91%, led by Chinese stocks. The index is down 8.2% so far this month.

Hopes that talks between Russia and Ukraine due to resume on Tuesday could provide a resolution to the conflict prompted a sharp fall in global oil prices.

However, the fourth round of negotiations began Monday with no major progress seen, adding to the nervousness in equity markets.

During the Asian session, U.S. crude slipped a further 2.54% to $100.44 a barrel, in line with broader asset selling. Brent crude was down 2.27% to $104.42 per barrel.

In U.S trading, oil prices had fallen as much as 5.8% as prospects of a positive outcome in Ukraine talks eased concerns about major supply disruptions.

But adding to the overall negative sentiment are rising case numbers of COVID-19 in China, which investors fear will hurt the mainland’s economic growth in the first quarter.

“Right now everyone is looking at the Chinese cases and realising that has to have an effect on production,” said Hong Hao, BOCOM International’s head of research.

“China’s growth in the first quarter could be closer to zero than 5.5%. There’s a ripple effect. There’s Ukraine, the risk of U.S. sanctions on China and rising Chinese domestic COVID cases – it does not look good.”

Hong Kong’s Hang Seng Index (.HSI) remains mired in negative territory, dropping 3.8% early on Tuesday, following an almost 5% selloff one day earlier. Hong Kong’s main board is down 17% so far in March.

China’s CSI300 index (.CSI300) was down 2.3%.

China on Tuesday reported 3,602 new confirmed coronavirus cases compared with 1,437 on Monday, according to the National Health Commission.

Investor focus is also on the U.S Federal Reserve, which meets on Wednesday and is expected to hike interest rates for the first time in three years to offset rising inflation.

Full coverage: REUTERS

All Eyes On Approaching Fed Meet, Yen Slips Further

The yen remained under pressure on Tuesday and the Australian dollar was bruised by the latest lockdowns in China following new COVID-19 outbreaks, but moves were more muted than in recent days as traders eyes turned to this week’s Fed meeting.

The U.S. Federal Reserve is set to raise rates for the first time since the pandemic at its meeting which concludes Wednesday, with traders looking for indications about the pace of future rate hikes.

Markets anticipate a 25 basis point rise at this meeting, according to the CME’s Fedwatch tool, but pricing has risen to indicate a 70% chance of a larger 50 basis point hike at its subsequent meeting in May, due to concerns about inflation.

“We think the statement and chair Powell’s press conference after the meeting will be influential in terms of market pricing for a 50 basis point rise in May and beyond, and that will impact the U.S. dollar intraday,” said Carol Kong, an FX strategist at Commonwealth Bank of Australia.

The dollar index, which measures the greenback against six major peers was at 99.108, not far off the 99.415 touched a week ago, its highest level since May 2020.

The yen was at 118.37 per dollar on Tuesday morning, after tumbling sharply in recent sessions as the contrast between rising benchmark rates in the United States and low rates in Japan becomes ever more apparent as the Fed begins to tighten.

The return of risk sentiment to markets, partly on the back of hints of a negotiated end to the war in Ukraine, has also taken away some of the support for the safe-haven Japanese currency.

Russian and Ukrainian delegations held a fourth round of talks on Monday but no new progress was announced. Discussions were due to resume on Tuesday.

The euro was fairly steady at $1.0947.

Traders were also watching the Chinese yuan which weakened to a one-month low against the dollar on Monday, breaching a key threshold, pressured by rising expectations of monetary policy easing and worries over the fast spread of locally transmitted coronavirus cases, which caused lockdowns in some cities.

Full coverage: REUTERS

Oil Falls On Ukraine Talks, Fears Of Slower Demand In China

Oil prices slid to a two-week low on Tuesday on continued ceasefire talks between Russia and Ukraine and concerns about demand in China after a surge in COVID-19 cases.

Brent futures dropped $4.20 or 3.9% to $102.70 a barrel by 0125 GMT after falling 5.1% the previous day.

U.S. West Texas Intermediate (WTI) crude fell below $100 level for the first time since March 1, dropping $4.30 or 4.2% to $98.71 a barrel. That followed a 5.8% tumble the previous day.

“Expectations of positive developments in the Russia-Ukraine ceasefire talks bolstered hopes to ease tightness in the global crude market,” said Toshitaka Tazawa, an analyst at Fujitomi Securities Co Ltd.

“Fresh lockdowns to curb the COVID-19 pandemic in China also raised concerns over slower demand,” he added.

Mainland China posted a steep jump in daily COVID-19 infections on Tuesday, with new symptomatic cases more than doubling from a day earlier to a two-year high as a virus outbreak expanded rapidly in the country’s northeast.

Ukraine’s President Volodymyr Zelenskiy said late on Monday that negotiations with Russia, the world’s second largest crude exporter, will continue on Tuesday.

Zelenskiy also said he spoke with Israeli Prime Minister Naftali Bennett as part of a negotiation effort to end the war with Russia “with a fair peace.”

The United States warned China after “intense” talks on Monday against helping Moscow in its invasion of Ukraine.

International Energy Agency (IEA) chief Fatih Birol on Monday urged oil-producing countries to pump more to stabilise markets affected by the war in Ukraine.

British Prime Minister Boris Johnson is trying to persuade Saudi Arabia to increase its oil output, a senior minister said on Monday, following reports that Johnson would travel to the OPEC heavyweight this week.

Full coverage: REUTERS