Today’s News

In Shanghai and Singapore, there has been a notable migration of cash from China to Hong Kong as domestic investors move their money to more attractive assets amidst a weakening yuan.

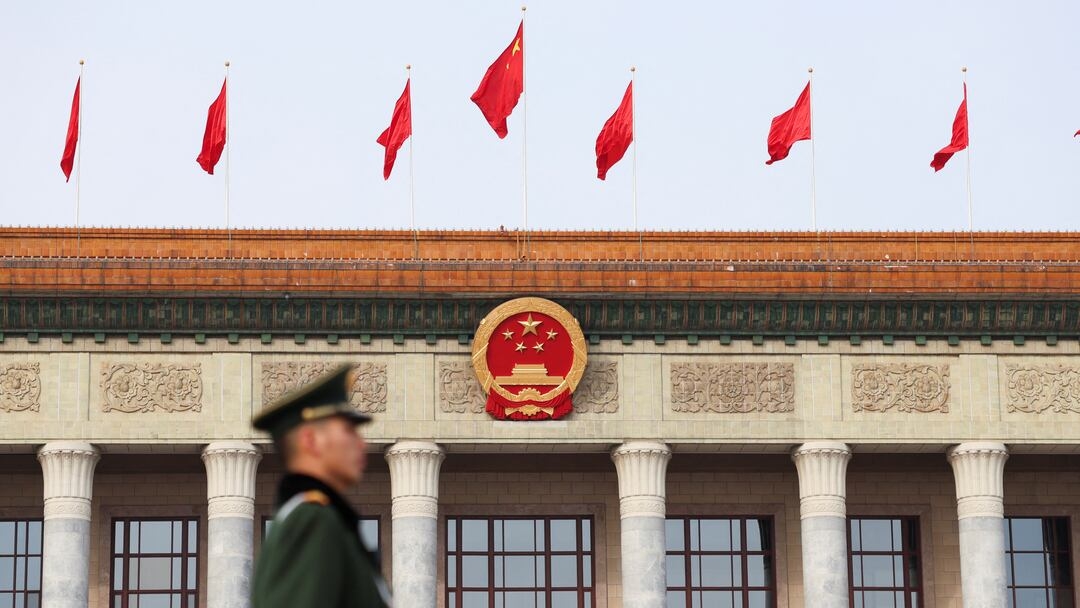

Image Source: Bloomberg

The Chinese currency hit a seven-month low this week, coinciding with a shift in investment flows, which now favor Hong Kong’s higher yields. This migration is compounded by companies gearing up to distribute annual dividends, which has further increased yuan deposits in Hong Kong.

Gary Tan from Allspring Global Investments in Singapore noted a downturn in market sentiment towards China, despite previous improvements. He stated, “Sentiment on China soured over the past month as the market has rallied ahead of improvement in macro data which continues to disappoint.” Tan also remarked on the evolving perspective of mainland markets, which have shifted from being viewed as “uninvestible” to showing signs of potential recovery.

Investor frustration is growing due to the delay in expected governmental stimulus, particularly aimed at supporting the struggling property sector. Following a significant rally from early February to mid-May, the Shanghai benchmark stock index has fallen by 6%.

Meanwhile, domestic investors have been actively channeling funds into Hong Kong, with significant sums also being withdrawn by foreigners this month.

Image Source: Reuters

Chi Lo of BNP Paribas Asset Management highlighted that foreign funds have adopted a neutral stance on Chinese stocks but are slowly becoming more optimistic. He anticipates that the upcoming July plenum of China’s Communist Party will confirm the continuation of progressive easing measures, stating, “Beijing is likely to keep the easing measures more progressive than they were in the past 18 months, in my view, and the plenum will likely reiterate that policy direction.”

The People’s Bank of China’s management of the yuan’s daily rate has sparked speculation of a strategic depreciation to alleviate financial pressures. This year, the yuan has depreciated by 2.2% against the dollar. As cash continues to flow into Hong Kong, yuan deposits in the city have surged to near-record levels, achieving figures comparable to those last seen in January 2022.

Mainland Cash Flows into Hong Kong

Ju Wang of BNP Paribas discussed the strong attraction of Hong Kong for mainland investors seeking better returns on their offshore yuan due to low domestic yields and the prospect of further monetary easing. She also mentioned that the seasonal increase in transactions related to dividend payments by Chinese firms in Hong Kong has fueled demand for the Hong Kong dollar and impacted the offshore yuan’s value.

The anticipated easing of U.S. interest rates, given Hong Kong’s currency peg to the U.S. dollar, is also expected to significantly influence Hong Kong’s financial liquidity and asset prices. Chi Lo added, “U.S. rate cuts are very important for Hong Kong’s liquidity because of the currency peg, so once the Fed starts cutting rates, I think we will be flush with liquidity here, which will push up asset prices.”

(USD 1=7.2610 Chinese Yuan)

Other News

Quant Mutual Fund Responds to SEBI Queries

Quant Mutual Fund, India’s fastest-growing fund house, is cooperating with the Securities and Exchange Board of India (SEBI) amid investigations into alleged “front running” activities. The fund is actively providing required data to SEBI.

Asian Markets Eye BOJ Moves, China Rebound

Investors are watching for potential Japanese yen interventions and a rebound in Chinese stocks as Asia enters the final trading week of the first half. Upcoming BOJ minutes and economic data from Singapore and Taiwan will be key drivers.

Asian Stocks Remain Cautious Amid Inflation Data

Asian markets remained subdued as investors awaited U.S. inflation data and monitored geopolitical events, including the U.S. presidential debate and French elections. The Nikkei dipped slightly, while S&P and Nasdaq futures saw minimal gains.