Before the tensions over the Russia-Ukraine war, aggressive Fed rate hikes, and the slowing corporate earnings could ease, the market turmoil has set a stage for itself as mounting losses as high as 27% are surfacing in the U.S. stock market within this year.

An Overview of The 3 Major Indexes In 2022

2022 has been a brutal and difficult year so far for the global stock market. At the beginning of 2022, the U.S. stock market saw its worst first month of the year since the global financial crisis in 2009.

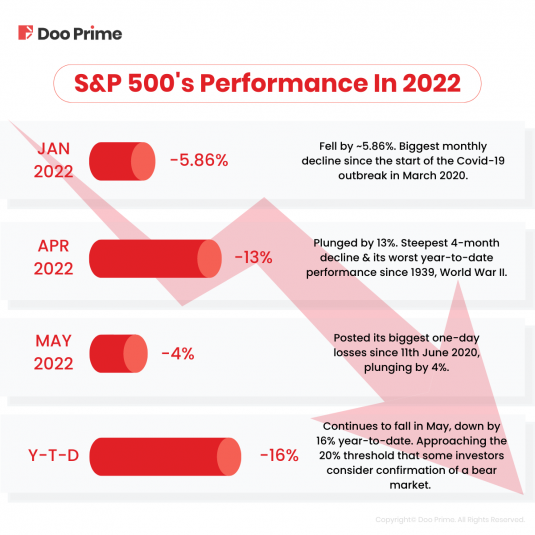

During this interval, the S&P 500, known as the main benchmark for the U.S. stock market’s performance, fell by approximately 5.86% in January, which was its biggest monthly decline since the start of the Covid-19 pandemic in March 2020.

Through April, the S&P 500 plunged by 13%, its steepest four-month decline and also its worst year-to-date performance since 1939, World War II.

On Wednesday, 19th May 2022, the S&P 500 posted its biggest one-day losses since 11th June 2020, plunging by 4% or 165.17 points to finish at 3,923.68 points.

The index continues to fall in May and was down 16% year-to-date as of Tuesday’s close, approaching the 20% threshold that some investors consider confirmation of a bear market.

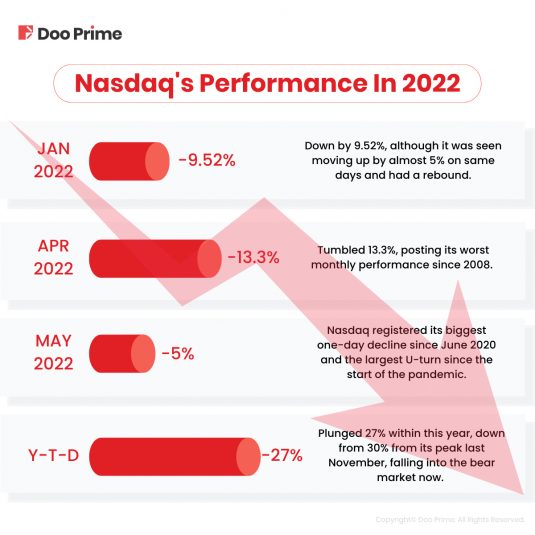

As for tech-heavy Nasdaq 100, it was down by 9.52% in January 2022, although it was seen moving up by almost 5% on the same days and had a rebound, posting a nearly 6.6% surge in the last two sessions.

In April, the Nasdaq Composite tumbled 13.3%, posting its worst monthly performance since 2008. Then, on 6th May 2022, Nasdaq registered its biggest one-day decline since June 2020 and the largest U-turn since the start of the pandemic.

Later on 19th May 2022, when S&P 500 and Dow Jones marked their biggest one-day loss since June 2020, Nasdaq fell by 4.73% to 11,418.15 points.

Within this year, the Nasdaq has plunged 27% just this year, down from 30% from its peak last November, falling into the bear market now.

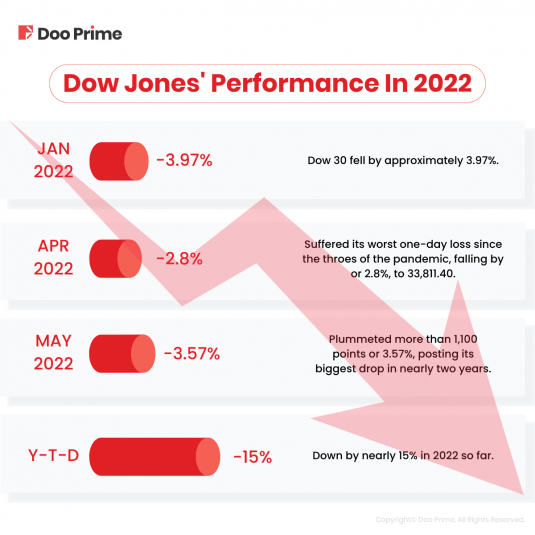

Similar to the other two major indexes, the Dow 30 fell by approximately 3.97% in January.

On 22nd April 2022, the Dow Jones Industrial Average suffered its worst one-day loss since the throes of the pandemic, falling by 981.36 points, or 2.8%, to 33,811.40. At that time, Dow was seeing a four straight weekly decline and ninth losing week.

U.S. stocks hit their darkest day on 18th May 2022 as Dow plummeted more than 1,100 points, posting its biggest drop in nearly two years and it continued to fall on 19th May 2022 by more than 400 points or 1.36%.

That said, Dow Jones coupled with S&P 500’s biggest one-day loss since June 2020. At this point, the Dow is down by nearly 15% in 2022 so far.

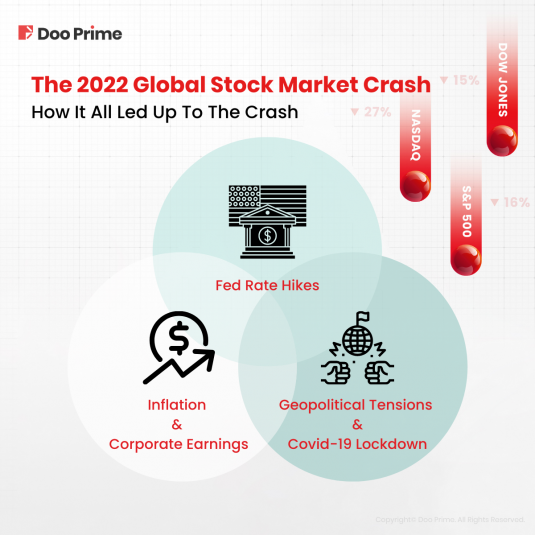

How It All Led Up To The Crash

As indicated from the data above, the U.S. stock market has recorded the biggest daily drop in almost two years. And of course, there must be a cause for it.

Investors have been fleeing risk assets due to a confluence of intertwining factors, including persistent high inflation, slowing economic growth, the war in Ukraine, supply shocks from China, and most importantly, the prospect of interest rate hikes from central banks looking to rein in consumer price increases.

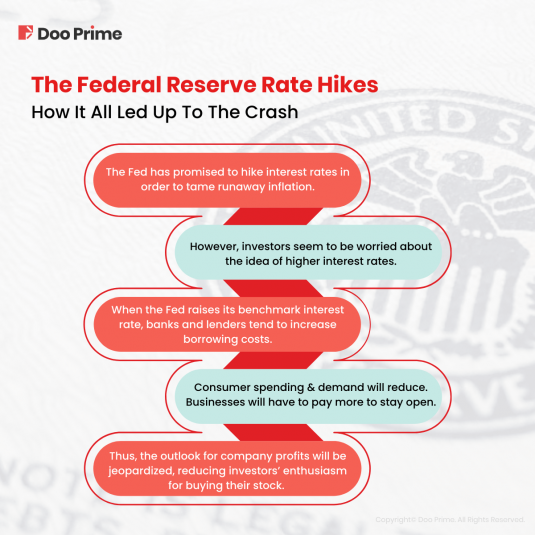

The Federal Reserve Rate Hikes

This year, the Fed has promised to hike interest rates in order to tame runaway inflation, which has recently hit its highest level in four decades.

However, investors seem to be worried about the idea of higher interest rates, and here are the two major justifications to it:

- Higher rates could lead to a possible slowdown of the U.S. economy.

- They could also forge other investments like bonds to become more attractive as compared to stocks.

As a matter of fact, when the Fed raises its benchmark interest rate, banks and lenders tend to increase borrowing costs too. Credit cards, mortgages, and other debt become more expensive, and these factors will reduce consumer spending and demand. Therefore, businesses have to pay more to stay open.

Against this backdrop, the outlook for company profits will be jeopardized, reducing investors’ enthusiasm for buying their stock.

Inflation & Corporate Earnings

Some market participants believe that the selloff in global risk assets against a backdrop of surging inflation and slowing growth is only getting started.

The brutal stocks’ selloff appeared to set a turnabout of thinking in the markets, as cracks surfaced after disappointing quarterly earnings results of big-name retailers.

Target’s shares saw a decline of over 25% after the company warned of rising costs, impacting profits, with the stock on pace for its worst single-day drop in roughly 25 years.

Walmart posted a gloomy outlook, followed by a profit miss, also due to rising costs, causing shares to fall 11% in their largest one-day drop since 1987.

Thus, this is a sign that surging inflation is seeping into just about every corner of the U.S. economy.

“For the past year, investors, traders, and professional forecasters have all stayed optimistic that inflation will eventually subside. Markets have yet to price in a worst-case scenario for the economy, in which inflation fails to come down and/or the U.S. falls into recession”, analysts said.

“The whole economy is being affected through this robust inflation we’re seeing and I don’t see any type of resolution until equity prices start reflecting lower GDP and lower earnings growth,’’ said Tom di Galoma, a Treasurys trader at Seaport Global Holdings in Greenwich, Connecticut.

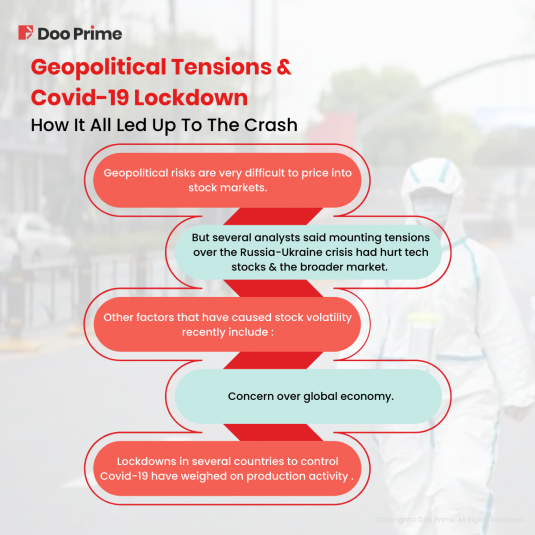

Geopolitical Tensions & Covid-19 Lockdown

Geopolitical risks are very difficult to price into stock markets, but several analysts said mounting tensions over the Russia-Ukraine crisis had hurt technology stocks and the broader market in the second half of January.

For example, the turmoil has caused a supply shock that has helped drive up oil and other commodity prices, while also triggering particular concerns about Europe’s economy.

Other factors that have caused stock volatility recently include concern over China’s economy. Lockdowns in the country to control Covid-19 have weighed on production activity there.

In-Depth Analysis On The Stock Market Crash & What’s Next

Now that we have all the facts laid out, let’s take a look at what Doo Prime’s in-house analyst, James Gomes, who has been in the finance industry for over 30 years, has to say about this ongoing market selloff.

The stock market’s recent selloff is a continuation of the risk-off we have experienced since the Federal Reserve talked about and delivered on a 50bps hike.

This was done to combat a stubbornly high inflationary environment experienced in the U.S. and around the world. The surging inflation is to be blamed on the reopening of economies after the Covid-19 lockdowns, then plagued by supply chain issues.

To make matter worse, the invasion of Ukraine has caused energy and commodity prices to levels not seen in a long time. And now, we have the lockdown in China to pour oil on the fire of the supply chain issues.

With all these spells on things, inflation is definitely not coming down anytime soon.

The posture taken by the Fed, and the latest Powell comments, only confirms that they are worried and may raise more hikes than expected to bring inflation down.

To add, the strong job market gives confidence to the Fed that they can go ahead and be more aggressive without damaging the economy too much. At least that’s the thinking.

On the other hand, the recent earnings from Walmart and Target indicate that even the so-called “safe stocks” are not immune to rising costs. Thus, there is nowhere to hide. Even crypto is under pressure after the collapse of Luna.

The market will be volatile in the near term until we get an idea of how far the Feds will go and how much damage it will do to the economy.

In the meantime, be prepared that the selling may not be over yet.

What’s Next?

As a result of market cycles, stock market crashes are an inherent risk of investment. No matter how high an index rises, there is only so much it can grow before sellers take action.

However, market downtrends do not have to result in a crash, so long as cooler heads prevail.

While this crash certainly will not be the last one the U.S. will experience, it is not clear how long this will last or before we see the next one.

Ultimately, this on-going stock market crash makes an excellent case study as to how quick, smart federal intervention can mitigate the worst effects of a crash.

Keep an eye on Doo Prime’s weekly market commentary and daily analysis on DooPrimeNews.com to stay abreast of this ongoing market turmoil.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.