Crude Oil has officially posted its sixth consecutive weekly gain, marking the longest streak since the start of the Russia-Ukraine war. The price of WTI crude oil reached over USD 82 per barrel, its highest level since April 2023.

These recent crude oil price fluctuations might spark a global energy war.

The Russia-Ukraine conflict shook the foundation of the global economy and had an immense impact on key geopolitical ties. For eighty years, Saudi Arabia had a bargain with the U.S., promising a reliable supply of oil to the Americans in exchange for U.S. security against any potential threats. Today, this nearly century-old alliance is facing an extraordinary test.

While the U.S. Federal Reserve celebrates its success in reducing inflation, the recent surge in Crude Oil prices is telling us a whole different story.

Is inflation coming back? How will the Fed respond if oil prices keep on rising?

In this article, we will explore and understand the underlying factors of this sudden increase in oil prices. Additionally, we will analyze how investors can potentially benefit from this volatility, while being mindful of the potential risks that lie ahead.

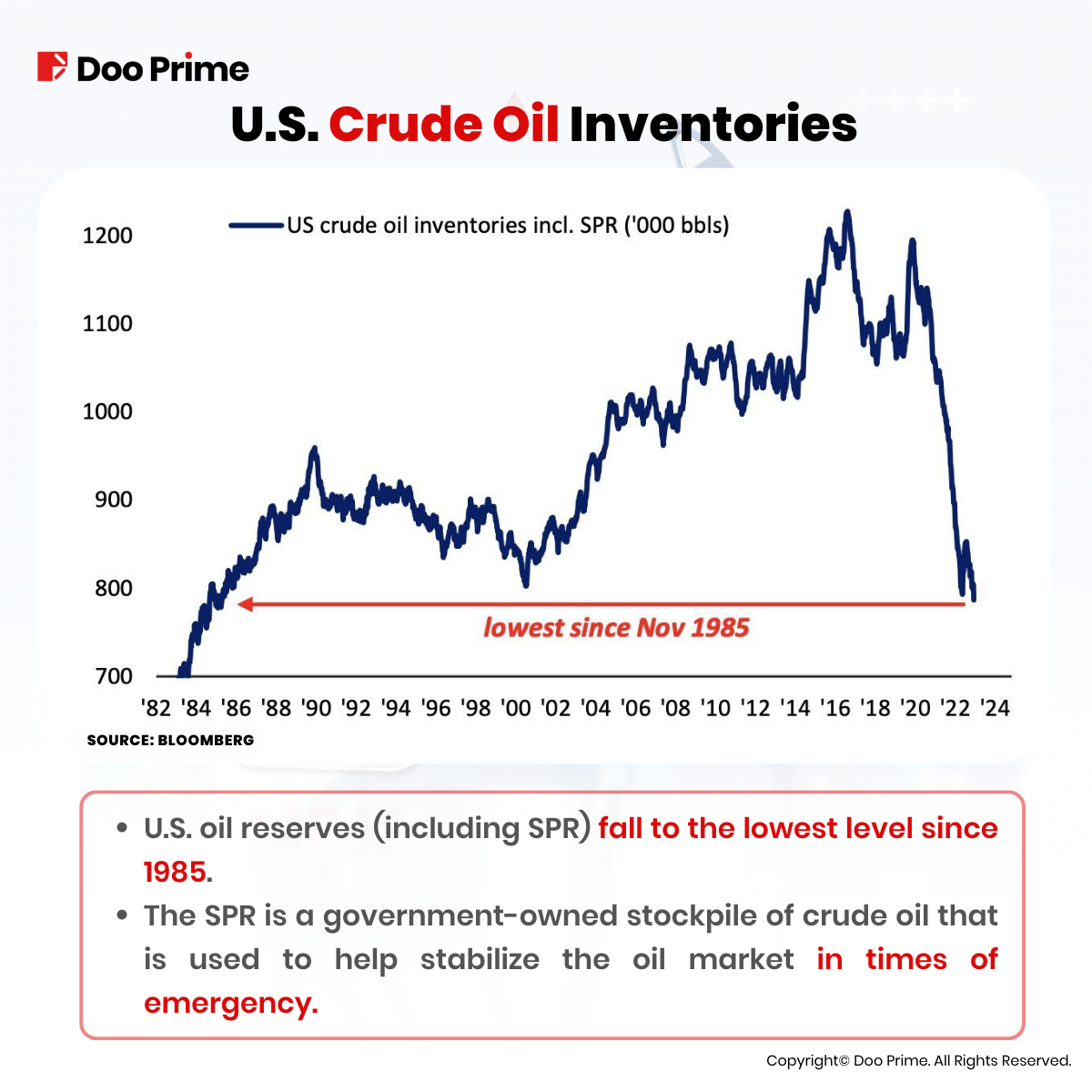

U.S. Oil Inventory Lowest Since 1985

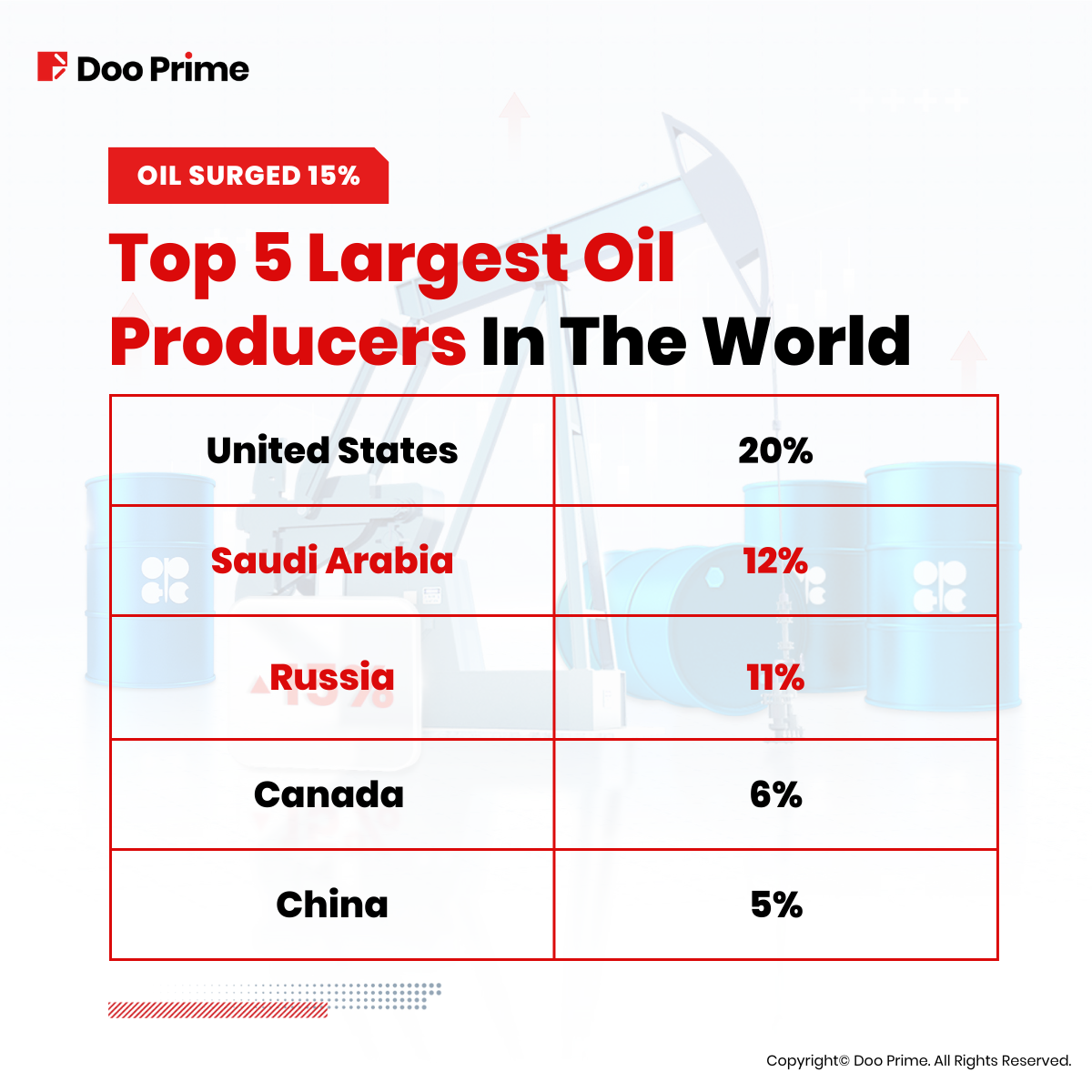

The war in Ukraine has disrupted global energy markets, and ever since then the United States has been looking to Saudi Arabia to help stabilize prices and reduce inflation. However, Saudi Arabia has been reluctant to increase production to maintain a competitive edge in the market share race with Russia (Russia: 11%, Saudi Arabia 12%) and to benefit from the potential advantages of higher oil prices. Higher prices could be crucial for funding their ambitions futuristic megacity project known as ‘Neom’.

In the most recent OPEC+ meeting, the Kingdom of Saudi Arabia has voluntary extended its oil cut by one million barrels per day, hinting the possibility of deeper cuts in future meetings. This stance could escalate tensions between the two countries, after 78 years of a bilateral contract. Will Saudi Arabia and the U.S. be able to maintain their alliance in the long-term?

U.S. oil reserves are now at their lowest level since 1985. The decline of U.S. reserves over the last 2 years is faster than any time in history. On August 1st, the U.S. announced that it would once again postpone refilling the Strategic Petroleum Reserve (SPR) due to “market conditions and higher prices”.

The Biden Administration has had massive withdrawals from the SPR. Over 221 million barrels were withdrawn from the reserve in 2022 alone in response to inflation and geopolitical conflicts. The SPR now holds 346 million barrels of crude oil, its lowest level since 1983.

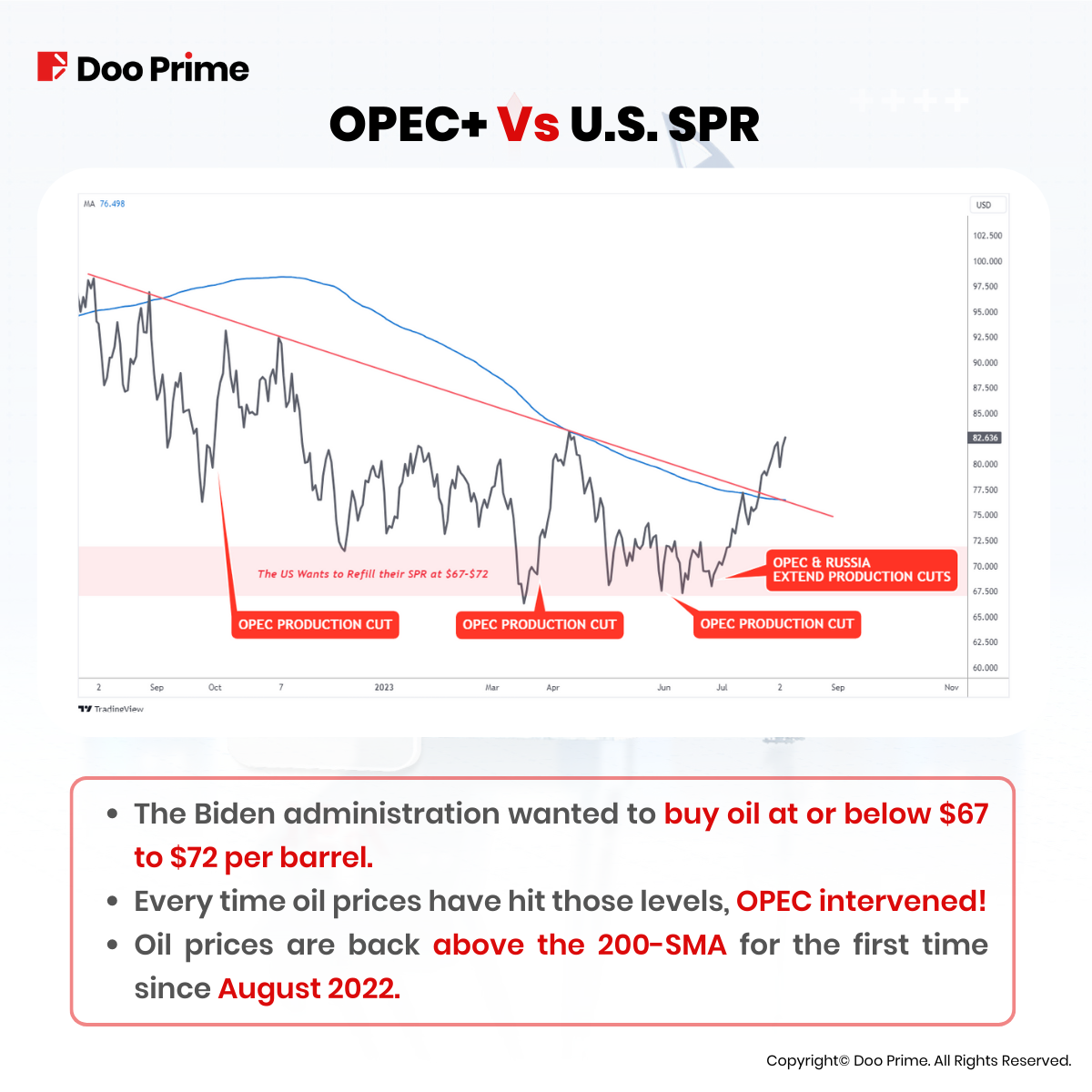

OPEC+ Vs U.S. Strategic Petroleum Reserve

In October 2022, the Biden administration announced its intent to refill the SPR. A statement said they plan to make purchases when oil prices are “at or below USD 67 to USD 72 per barrel.” However, every single time oil prices have hit that level this year, OPEC has taken action. Currently, we are around 20% above that level as oil prices are now nearing their yearly highs.

On June 9th, the U.S. refilled 6 million barrels of the SPR, still well below the 250 million+ that have been drained. At the time, oil prices were right around USD 70 which is in the price zone that the U.S. wants to refill the SPR.

Promptly thereafter, the Saudi Arabia and Russia extended recent crude oil production cuts. This is not the first time that OPEC has taken action when oil prices hit the USD 67 to USD 72 zone this year. Could this be only a coincidence?

Every single time oil prices fell to USD 67-72, where the U.S. wants to fill the SPR, OPEC has cut oil production. Most recently, on July 3rd Saudi Arabia and Russia agreed to voluntarily extend production cuts, triggering this recent 20% rally in oil prices. This news does not bode well for the U.S. as they can no longer fill the reserve at their desired prices.

The Strategic Petroleum Reserves are being depleted day by day. Higher oil prices have been a major contributor to inflation which the Federal Reserve and U.S. government have been fighting for 2 years now. If OPEC+ and Russia continue to reduce oil production, it will push inventories lower and demand will likely increase, which could send oil prices much higher towards USD 90-100 by the end of this year.

Clearly, refilling the SPR is incredibly important for the U.S. and Crude oil reserves are a strategic asset that they need. For now, the energy war is here to stay as energy resources are being weaponized.

Rising Oil Prices: Is Inflation Coming Back?

The decline in gasoline prices over the past year had played a pivotal role in reducing the overall inflation and triggering a strong stock market rally. However, persistent higher oil prices could force the Fed to stay hawkish and not cut rates as the market might hope.

Once again, the Federal Reserve finds itself in a difficult spot. On one hand, they have OPEC+ and Russia reducing oil production, and on the other hand, raising rates could weigh down the economy further, potentially increasing the odds of a recession by triggering a deflationary cycle.

But that’s not the only bad news for the Fed.

According to the International Energy Agency (IEA):

- Global oil demand is expected to grow by 2.2 million barrels/day in 2023, reaching 102.1 mb/d.

- China, the world’s largest oil importer, is expected to account for 70% of global oil demand growth in 2023.

J.P. Morgan, in its turn, outlined a few reasons for hedging against a ‘Black Swan’ event, pointing to the potential for oil and commodity prices to unexpectedly spike and trigger an inflation shock in the market.

Investors need to stay vigilant, and the Federal Reserve will need to carefully weigh these factors before making a decision about interest rates in the coming months.

What’s Next For WTI Crude Oil?

To sum up, the recent surge in oil prices is a sign of the changing geopolitical landscape and the potential for higher inflation in the coming months. The U.S. and Saudi Arabia are facing an extraordinary test of their alliance, and the Fed is in a difficult spot as it tries to balance the need to increase rates to combat inflation with the risk of triggering a recession. Investors should be mindful of the potential risks and volatility in the oil market, but there are also opportunities to potentially profit from the current situation.

Here is some more food for thought on the future of oil prices:

- The oil market is likely to remain volatile in the near future, as the global economy recovers from the COVID-19 pandemic and geopolitical tensions continue to influence.

- Oil prices could continue to rise and potentially reach USD 100/barrel, if OPEC+ and Russia continue to reduce production, or if demand increases due to economic growth.

- However, oil prices could also fall if higher interest rates hinder global economic growth or if OPEC+ decides to increase oil production.

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime, an international preeminent online broker under Doo Group, strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 130,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment, and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please ensure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to learn more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.