Despite the “streaming bubble” gradually shrinking, Netflix has reinforced its position as the market leader with impressive Q1 and Q3 revenue reports in 2024. Notably, the highly anticipated match between Mike Tyson and Jake Paul became a global phenomenon, garnering an extraordinary 65 million live views. This event also marked Netflix’s significant entry into live sports broadcasting—a bold move into a highly competitive yet promising sector. The question remains: will this strategy be enough to ensure a strong finish for Netflix in 2024?

In this article, we’ll delve into the driving forces behind Netflix’s current success and explore its growth prospects as it heads into the final quarter of the year.

Mike Tyson vs. Jake Paul: Netflix’s Bold Strategy

In 2024, Netflix made a pivotal move by streaming the highly publicized match between Mike Tyson and Jake Paul. This wasn’t just another sporting event—it was a strategic decision signaling Netflix’s ambition to expand into live sports broadcasting, a domain filled with both immense potential and fierce competition.

Why Mike Tyson vs. Jake Paul?

Although Netflix wasn’t the first platform to broadcast live sports, the decision to host this particular event was undeniably daring.

Massive Engagement Potential: The idea of boxing legend Mike Tyson stepping into the ring at nearly 60 years old captivated millions of fans eager to see his return after almost two decades.

Controversy as a Draw: Jake Paul, a social media celebrity known for his polarizing image, added a layer of intrigue. While some dismissed the fight as a money-making stunt, the buzz surrounding it drove significant pre-event discussions.

Netflix’s Strategy: Why is it Quite Risky?

The match, hailed as a “must-see” event, failed to fully meet expectations.

- Event Shortcomings: Fans experienced streaming delays, poor video quality, and audio disruptions throughout the night, tarnishing the event’s reputation.

- Audience Backlash: Many viewers turned to X (formerly Twitter) to express their frustration, with one post garnering over 27,000 likes, stating, “If Netflix doesn’t fix this, it will go down as one of the biggest failures in streaming history.”

Despite the criticism, this bold move underscores Netflix’s intent to challenge major players like Amazon (NFL with Thursday Night Football) and Disney+ (ESPN). It marks a significant milestone in Netflix’s broader content strategy.

Look Back at Netflix’s Q3 Performance

Since the start of the year, Netflix has added 13 million paid accounts, reaching an all-time high of 282.7 million subscribers by Q3 2024.

Key highlights from the Q3 earnings report include:

- Revenue: $9.83 billion, surpassing the forecast of $9.77 billion.

- Earnings Per Share (EPS): $5.40, exceeding the expected $5.12.

- Net Income: $2.36 billion, up from $1.68 billion in the same period last year.

- Ad-Supported Plans: Membership for these plans grew by 35% compared to the previous quarter.

Can Q4 deliver similar results? The answer seems promising.

Netflix 2024: Q4 Growth Prospects

The global Subscription Video on Demand (SVoD) market is experiencing robust growth, with projected revenue of $108.50 billion in 2024. This figure reflects the sector’s strong potential as more consumers transition to streaming over traditional entertainment methods.

CAGR Growth: The market is expected to grow at a compound annual growth rate (CAGR) of 8.27% from 2024 to 2027, reaching a staggering $137.70 billion by 2027.

User Base Expansion: By 2027, the global SVoD market is forecasted to reach 1.6 billion users, highlighting widespread adoption and increasing demand for video streaming services.

These numbers underscore the enduring relevance and growth opportunities for streaming platforms like Netflix.

The Comeback That No One Expected

It’s all about strategies! Netflix’s expansion into ad-supported plans has been a resounding success.

- Ad Membership Growth: Memberships for ad-supported plans grew 35% QoQ.

- Future Projections: Netflix expects ad revenue to double by 2025 and has already secured advertising slots for two NFL games this Christmas.

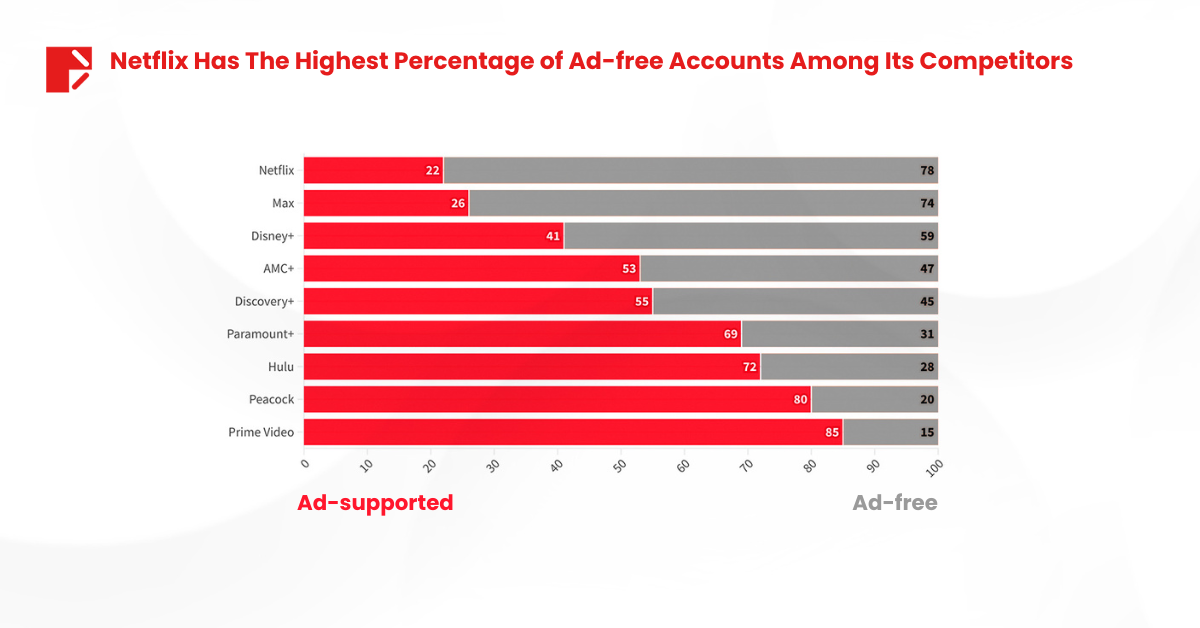

Interestingly, Netflix’s ad-supported accounts offer a higher revenue margin compared to competitors, with its non-ad accounts still holding the industry’s highest retention rate.

Additionally, research from the Advertising Research Foundation (ARF) shows that over 80% of households subscribing to services like Amazon Prime or Disney+ also watch Netflix. This unique position allows Netflix to offer advertisers unparalleled reach and reduced ad duplication.

Netflix Stock Performance (NASDAQ: NFLX)

Since the start of 2024, Netflix’s stock has surged over 80%, hitting a record high of $841 on November 14. This reflects investors’ confidence in the company’s growth potential and its ability to maintain a leading edge in a highly competitive market.

Technical indicators such as RSI, MACD, and moving averages currently signal a “buy” trend, further emphasizing Netflix’s bullish outlook.

Netflix 2024: The Edge of a Market Leader

With its strong revenue growth, expanding ad-supported memberships, and strategic risk-taking, Netflix continues to solidify its position as the premier streaming platform. However, challenges remain:

- Increasing Competition: Rivals like Disney+ and Amazon Prime are investing heavily in exclusive content.

- Content Strategy: Sustaining a pipeline of high-quality, exclusive content is critical.

- Technical Infrastructure: Ensuring seamless delivery, especially for live events, is a must to avoid reputational risks.

Investors should closely monitor Netflix’s Q4 earnings and industry trends to make informed decisions. Stay tuned for more insights on Netflix and the streaming industry in Doo Prime’s weekly market dive.