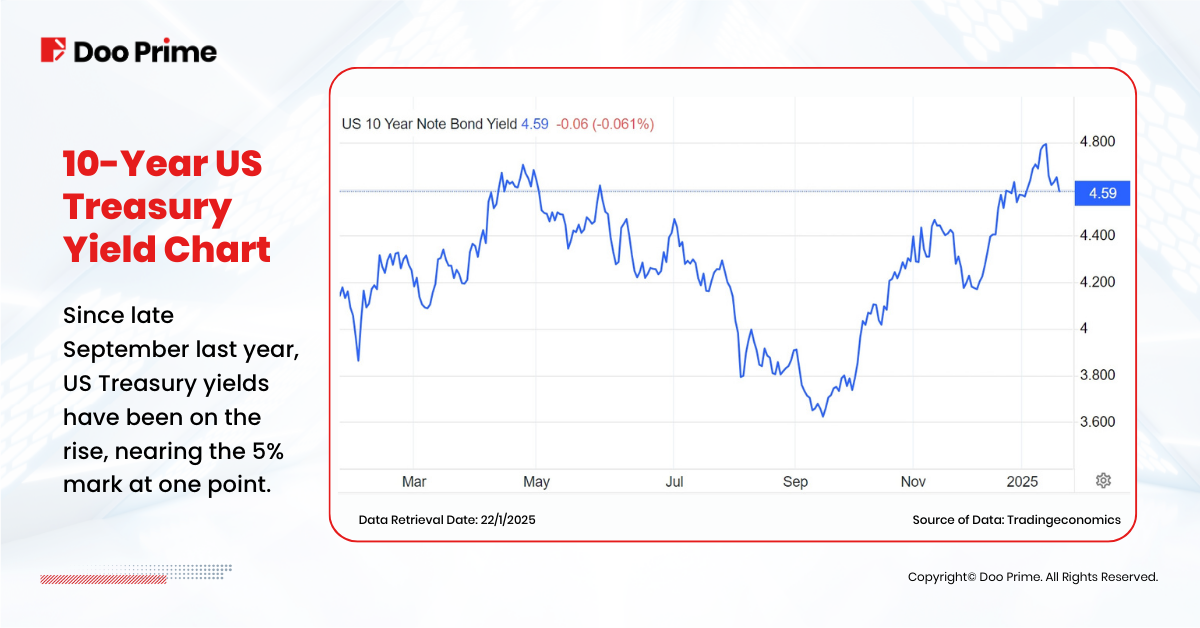

As 2025 begins, the US bond market has thrown investors into a state of unease. Persistent selloffs in US Treasury bonds have caused an “unusual” surge in yields, sparking concerns about their potential impact. By January 17, the 10-year Treasury yields had climbed above 4.6%, despite a brief dip following favorable inflation data. Investor sentiment remains cautious as the market faces these uncertainties.

Why Are High Treasury Yields Worrying for Investors?

The 10-year Treasury yield is often called the “anchor of global asset pricing” because it reflects the baseline return for low-risk investments in US dollars. Unlike short-term yields, which are highly sensitive to Federal Reserve rate changes, the 10-year yield influences borrowing costs, investment returns, and market valuations globally. A sustained rise in these yields could reshape the financial landscape, increasing borrowing costs and pressuring risk assets.

Why are yields rising now? Could they exceed the critical 5% threshold in 2025? This article examines the causes and potential risks of this trend.

What Makes the Current Rise in Treasury Yields Unusual?

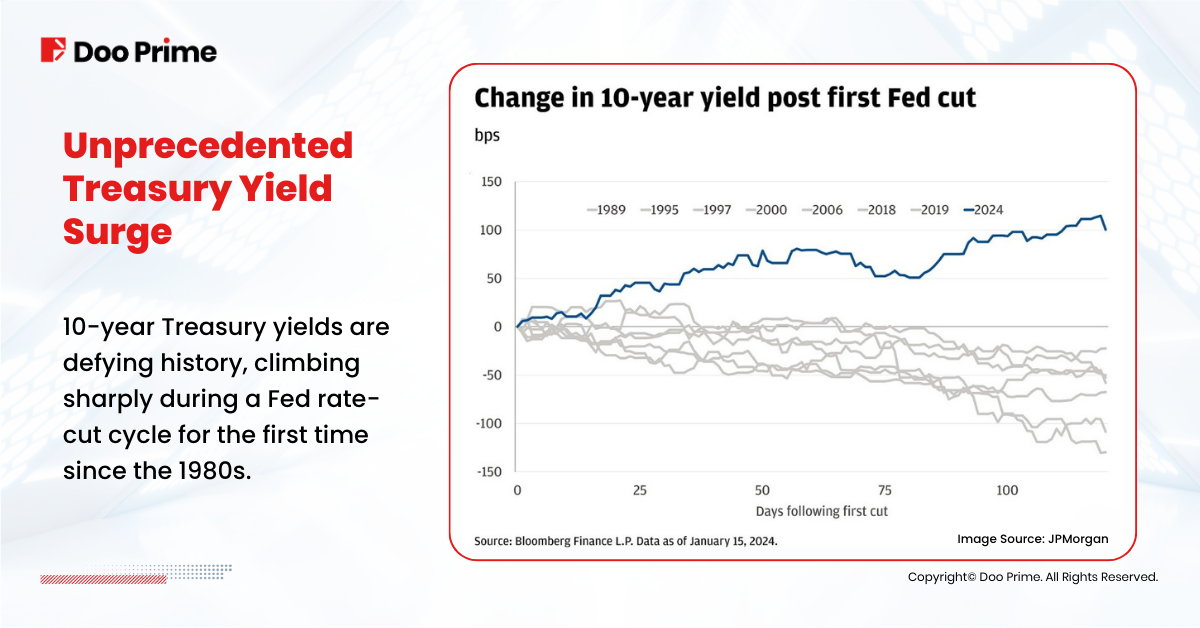

The rise in 10-year Treasury yields is striking because it has occurred alongside the Federal Reserve’s rate-cutting cycle. Historically, yields tend to fall within 100 days of the Fed’s first rate cut during easing cycles, a pattern observed since the 1980s. However, yields are now approximately 100 basis points higher than their September 2024 low, a clear departure from past behavior.

The Role of Real Rates and Term Premiums

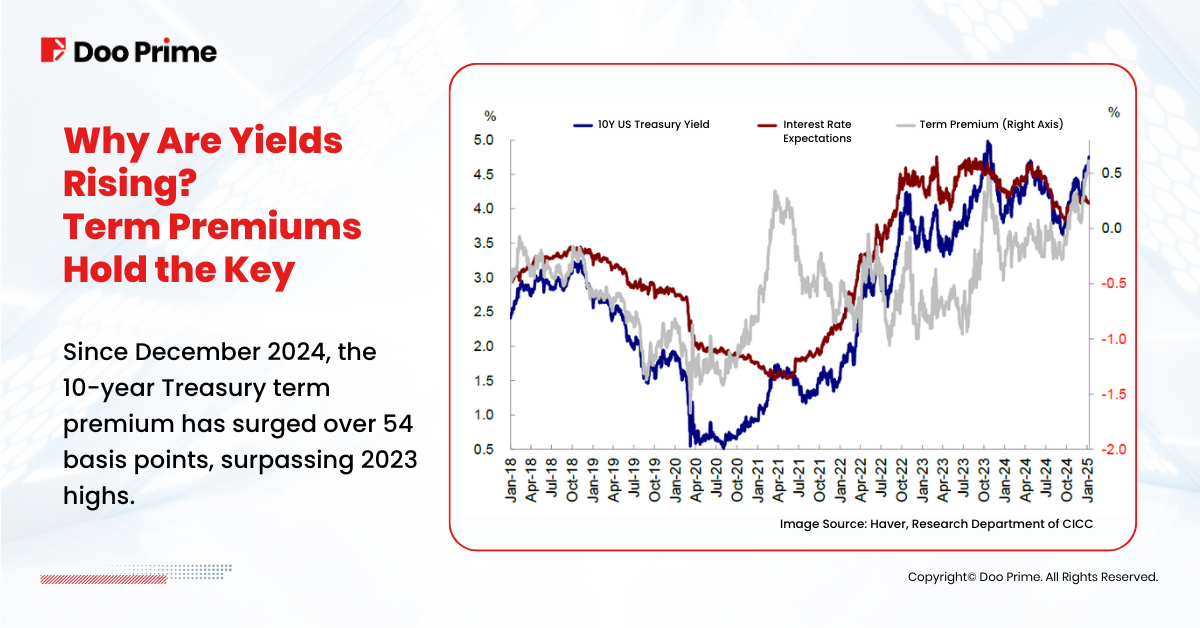

Research shows that higher real rates and rising term premiums are driving the increase in yields:

- Term Premiums: These are additional returns demanded by investors to hold long-term bonds instead of short-term ones, accounting for risks like inflation and policy uncertainties. Recent data suggests that term premiums have surged, driven by increased Treasury supply and greater compensation demands amid economic and policy uncertainties.

- Real Rates: These represent the inflation-adjusted returns on bonds. Rising real rates indicate a higher baseline return expectation, which has contributed to the upward pressure on yields.

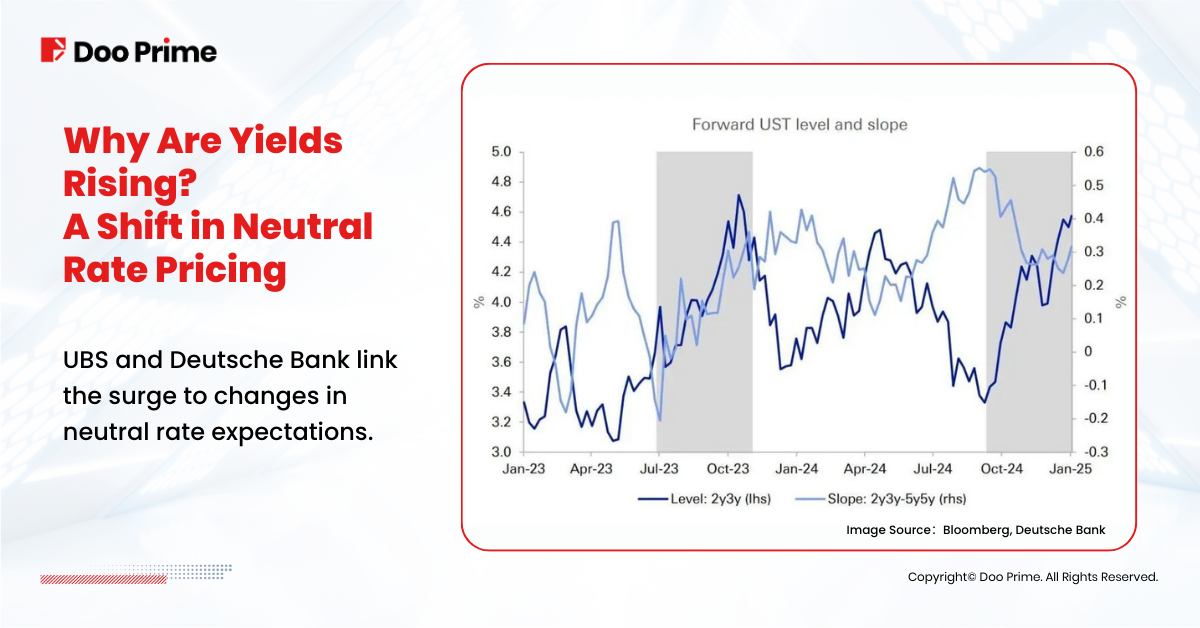

Shifts in Neutral Rate Pricing

Some analysts, including UBS and Deutsche Bank, argue that the yield rise reflects a shift in neutral rate pricing rather than term premiums. Deutsche Bank highlights that forward rates (e.g., 2y3y) have increased without a steepening of the forward curve (e.g., 2y3y – 5y5y), suggesting that changing expectations about long-term rates are at play.

Could 10-Year Treasury Yields Break the 5% Barrier?

While inflation data in January briefly slowed the rise in yields, the prospect of reaching or exceeding 5% remains a hot topic. Here are some expert perspectives:

- Shenwan Hongyuan Macro Team predicts that early uncertainties under President Trump’s administration could lead to heightened volatility in interest rates. However, as policies take shape, deviations from economic fundamentals are unlikely to persist. Weak economic data, potentially linked to tariff policies, could push yields lower.

- Morgan Stanley recommends that investors take advantage of the current yield levels by purchasing 5-year Treasury bonds. Analysts highlight easing inflation pressures and elevated term premiums as reasons to enter the market now.

How Rising Yields Could Impact US Stocks?

As 10-year Treasury yields climb, the potential repercussions for US equity markets are becoming increasingly apparent. According to the Chief Economist at Soochow Securities, tighter financial conditions driven by rising yields are likely to put significant pressure on risk assets. This shift could lead to a “good news is bad news” scenario, where positive economic data fuels concerns about further monetary tightening.

Julian Emanuel, Chief Strategist at Evercore ISI, emphasizes that higher long-term yields could create notable mid-term challenges for stocks. He asserts that equity markets may hold up with yields around 4.5%, but a breach of 4.75% would likely trigger deeper and more prolonged corrections.

Historical Insights on Rising Yields and Stocks

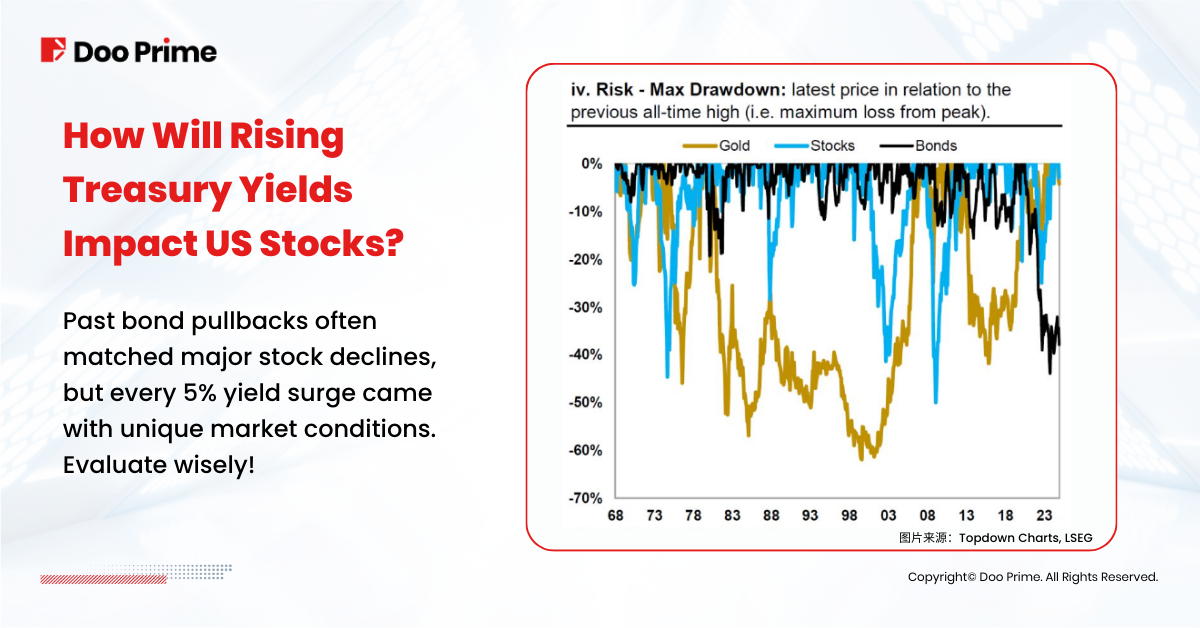

Historical data reinforces these concerns. Bond market pullbacks have frequently coincided with some of the most significant equity downturns, as rising Treasury yields increase borrowing costs for corporations and dampen investor sentiment. For example:

- In October 2023, the 10-year Treasury yield briefly touched 5.001%, its highest level in 16 years, before retreating to 4.99% by the close. On that same day, US equities experienced sharp losses.

- In 2022, long-term Treasury yields surged, contributing to a 19% annual decline in the S&P 500—the index’s worst performance in six years.

- In June 2007, yields exceeded 5%, just months before the onset of the Global Financial Crisis. This period demonstrated how high yields can amplify vulnerabilities in the financial system.

What Makes 2025 Different?

While historical patterns provide valuable lessons, it is essential to recognize that each period’s macroeconomic conditions are unique. For instance, the 2025 economic landscape—characterized by a new presidential administration and evolving fiscal policies—is markedly different from 2007 or 2023. These distinctions require a nuanced approach to assessing market risks and opportunities.

Key Takeaways for Investors

Investors should closely monitor the trajectory of Treasury yields and consider the potential ripple effects on equities. Understanding how higher yields impact borrowing costs, corporate performance, and market sentiment is crucial for making informed decisions in today’s volatile environment. Historical parallels can offer guidance, but adapting to current market dynamics will be key to navigating these challenges effectively.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.