The news is out: NVDA stock split 10:1, the largest in its history, is finally announced!

This means that effective June 10th, 2024, each share you hold will magically transform into ten! Or, if you are a new investor, you can now buy NVDA shares for 10 times less capital.

But before you jump in and buy a whole bunch of “cheaper” shares, let’s take a step back and start by defining what a stock split means and the impact that it could have on NVDA stock. Additionally, let’s analyze the fundamentals and technical aspects of Nvidia.

Divided by Ten, Value Stays the Same

At its core, a stock split is a financial maneuver that divides a company’s existing shares into more shares with a lower price tag. In NVIDIA’s case, each $1,000 share will transform into ten $100 shares. While it might feel like you’re getting a bargain, the total value of your holdings remains the same. It’s like cutting a pizza into ten slices instead of eight – you still have the same amount of pizza, just in smaller pieces.

Psychology behind the NVDA Stock Split

So why the excitement? Stock splits can trigger a psychological shift for investors, and especially the small investors. A lower share price can make the stock appear more affordable, especially for those new to the market or with limited capital. This can lead to a surge in buying activity, potentially driving the stock price up in the short term.

Focus on the Fundamentals: Beyond the NVDA Stock Split Hype

Let’s get back to our question: Is it time to buy the NVDA shares?

Yes, it could be the time, but not only because of Nvidia’s upcoming 10:1 stock split.

While the split might create a temporary buying frenzy, professional investors know that the real decision lies in the company’s fundamentals. Here are some key factors to consider before hitting that buy button:

First, Nvidia exceeded Wall Street estimates, driven by the performance of its AI-enabled GPU chips. Nvidia’s revenue surged to $26.04 billion in Q1 2024, a 262% year-over-year increase, largely due to the success of its H100 GPUs.

Second, Nvidia has increased its quarterly dividend by 150%, indicating strong financial health and an optimistic outlook.

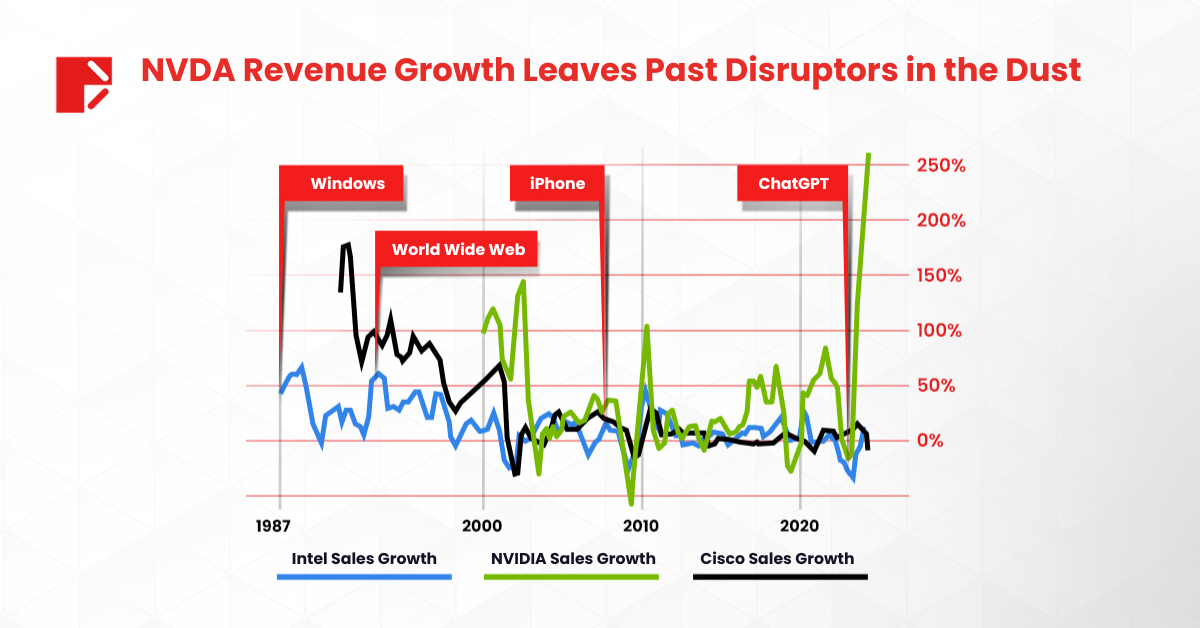

Third, Nvidia’s extraordinary revenue growth! Historically, key technological innovations such as Windows, the World Wide Web, and the iPhone drove notable sales growth for Intel and Cisco. However, Nvidia’s growth has surged dramatically with the rise of AI technologies, particularly ChatGPT, leaving the growth rates of past disruptors far behind.

Beyond making shares more accessible, stock splits often signal management’s confidence in continued growth. Despite the split, it’s crucial for investors to recognize that the underlying value of the company remains unchanged.

Buy Before or After the NVDA Stock Split?

The decision of when to buy depends on your investment capital, strategy, and risk tolerance.

If your capital allows it, you might consider buying shares before the NVDA stock split date. You could have an edge over the smaller investors who are waiting for June 10.

If you are a small investor, then waiting for the split date could be your best move. The momentum will likely remain high and continue stronger after June 10.

Technical analysis shows that Nvidia’s stock is trading above $1000/share for the first time in history, following the recent Earnings and stock split announcement.

A key support level currently sits at $950, which was the previous resistance.

If the stock holds above this support, it could indicate continued bullish momentum.

Traders should watch for price action around 950, which could offer buying opportunities.

The Final Word: A Split is a Tool, Not a Signal

A stock split is a financial tool, not a guaranteed buying opportunity. Don’t get swept away by the excitement. Focus on the company’s fundamentals, conduct your research, and make informed investment decisions based on your individual goals and risk tolerance. Remember, the best time to buy any stock is when the price aligns with your valuation of the underlying company’s future potential.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and the client should therefore be prepared to suffer significant losses when using such trading facilities.

Please ensure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to learn more.