On 24th February 2022, the world watched as Russia invaded its neighboring country, Ukraine. Days after recognizing the breakaway territories, Russia launched a full-scale invasion of Ukraine.

The invasion began in the eastern Ukrainian territory of Donbas. Volodymyr Zelenskyy, president of Ukraine, declared martial law in Ukraine, and subsequently officially broke diplomatic ties with Russia.

This is akin to a cold war in current times – and with it came implications in the financial and trade markets.

What Has Happened Since Russia Launched A Full-Scale Invasion Of Ukraine

1. International Recognition Of Donetsk And Luhansk As Two Independent States

On 21st February 2022, the State Duma of Russia passed a bill to officially recognize the self-proclaimed Donetsk People’s Republic and Luhansk People’s Republic in Eastern Ukraine as independent states. The bill was approved by President Vladimir Putin.

Putin stressed that the recognition of the areas controlled by the civil forces in eastern Ukraine as a state is relevant to the world and European security, as the use of Ukraine as a tool for confrontation with Russia is a serious threat to Russia.

Subsequently, the parties responded quickly. U.S. President Biden, German Chancellor Scholz, and French President Emmanuel Macron spoke on the phone to discuss how to coordinate the next steps in response to the Russian move.

The White House said Biden spoke with Ukrainian President Zelensky to reiterate the U.S. commitment to Ukraine’s “sovereignty and territorial integrity”. That said, the U.S. announced financial sanctions against Russia on 21st February and warned that they are prepared to impose additional sanctions if necessary.

2. Financial Nuclear War: Russia Kicked Out Of SWIFT

On the evening of 26th February 2022, the White House issued a statement announcing “devastating sanctions” against Russia, joining France, Germany, Italy, the U.K., and Canada in removing several major Russian banks from the SWIFT international settlement system.

The ruble instantly plunged 28% after the sanctions statement was issued. After all, the 2018 Iranian incident is there – Iranian financial institutions were cut off from the SWIFT system due to Western sanctions. In turn, this has caused its trade with the EU to plummet by 85% in the following year. Plus, the total GDP fell from 453.996 billion to 258.245 billion, nearly decimated.

3. Putin Signs Ruble Settlement Order, Russia Considers Bitcoin For Oil And Gas Settlement

On 23rd March 2022, Putin announced that Russia will implement a “Ruble Settlement Order” for natural gas on 1st April 2022. “To buy Russian gas, “unfriendly” countries and regions must open ruble accounts in Russian banks.” If the buyer refuses to pay in this way, Russia will consider that the buyer is in breach of the contract, and all consequences shall be borne by the buyer, and Russia will interrupt the supply of natural gas.

“If the payment is not completed (in rubles), we will consider it a breach of contract by the buyer and shall bear all the consequences that follow …… The existing contract will be terminated,” he said.

Russian energy accounts for a significant portion of European countries’ energy needs, with the European Union importing about 40 percent of its gas needs from Russia, settled in euros and dollars.

On 31st March 2022, Putin signed a presidential decree that new rules for paying for Russian gas in rubles to “non-friendly countries and regions” of Russia came into effect on 1st April 2022.

According to the document published on the Kremlin’s website, from 1st April 2022, companies from “non-friendly countries” should first open ruble accounts in Russian banks and then pay for their Russian gas purchases through these accounts.

On 24th March 2022, Russian State Duma Energy Committee Chairman Pavel Zavalny said at a press conference that Russia is considering accepting bitcoin as a payment method for its oil and gas exports. Since the Russia-Ukraine conflict, the West has imposed a series of tough sanctions on Russia in a bid to bring down the standard of living of the Russian population.

To add, Russian President Vladimir Putin announced that Russia would switch to using rubles for gas supplies to “unfriendly” countries and regions such as European Union member states, earlier this week.

Analysts’ Views On The Russia-Ukraine Crisis

Below, we have gathered several analysts’ and asset managers’ reactions on the Russia-Ukraine Invasion, plus the effect that came with it.

Dubravko Lakos-Bujas, Chief Equity Markets Strategist, JPMorgan:

“While the path of the Russia-Ukraine crisis remains unclear with potentially elevated market volatility in the short-term, tightening monetary policy, in our view, still remains the key risk for equities as central banks attempt to aggressively re-anchor inflation expectations lower.

“Overly restrictive monetary policy could result in an outright policy error especially if the business cycle continues to deteriorate. At the same time, the Russia/Ukraine crisis could force a reassessment of the Fed tightening path resulting in central banks turning less hawkish, while policymakers may consider additional fiscal stimulus.”

Mark Haefele, Chief Investment Officer, UBS Global Wealth Management:

“While we believe it is too early to make a final assessment on what Monday’s events may mean for the course of events, we remain of the view that the severe risk case we described earlier — including fighting and a prolonged interruption of Russian energy exports — still represents a tail risk at this stage.

“Allocations to commodities and energy stocks are an attractive option to help investors hedge portfolio risks. Energy prices would likely rise in the event of an escalation around Ukraine, as well as if cooler heads prevail amid rising demand and somewhat constrained supply.”

Charles Henry Monchau, Chief Investment Officer At Bank SYZ, Geneva:

“There is a high probability that tensions will start to abate from here on. Nevertheless, the worst-case scenario (full-scale conflict) can still happen. As such, we are keeping some protection in place (e.g Gold) and will refrain to add Russian assets at this stage (although they are starting to look very attractive from a valuation point of view).”

“These developments do not change our current portfolio positioning. It has been our view that equity and credit markets are more at risk from the war on inflation than on a potential invasion of Ukraine. Until we get more clarity on the inflation outlook, volatility is likely to remain elevated and stocks might have to go through more corrective phases.”

“Since the start of 2022, we have had a positive allocation to equity markets but with some portfolio protection in place (lookback put-spread options) and exposure to broad-based commodities and gold. The recent heightened risk level triggered a modest de-risking of the portfolios (reduced equity between 3% and 4% in balanced portfolios). Nevertheless, we have kept a positive exposure to global equities.”

Implications On Traders Around The World

The Russia-Ukraine conflict and imposed sanctions have undoubtedly affected the fate of multiple trading products. Let us take a look at the fluctuations the market went through during the time of the crisis.

Gold

On 24th February 2022, Russian troops arrived in Mariupol (a city in eastern Ukraine) and Odesa (a city in southern Ukraine). Immediately after Ukraine announced the closure of the national airspace, President Zelensky said that the entire territory of Ukraine will be in a state of war. According to the Ukrainian Ministry of Emergency Situations, the headquarters of the Ukrainian National Guard was destroyed.

Spot gold heard the news quickly and stood on the $ 1920 / ounce mark, hitting a new high in more than a year. On the night of 24th February 2022, before the U.S. market, according to Reuters witnesses, an explosion occurred in Kyiv, the capital of Ukraine.

Upon this incident, spot gold rose immediately, with an increase of more than 3%, standing at the $1,970 mark, a new high since November 2020, and an intra-day increase of more than 5%.

However, the rally reversed in the U.S. session. At the beginning of the U.S. session, spot gold fell by more than $30 in 15 minutes. It then fell below 1920 at one point, falling by $50 from the daily high.

In less than an hour from 22:30 to 23:20, there were four large transactions, with a total trading volume of $2.4 billion:

- On 24th February 2022, 22:33 (GMT+8), 2,804 lots were traded instantly within one minute, with a total trading volume of $545 million.

- On 24th February 2022, 22:41 (GMT+8), 2,590 lots were traded instantly within one minute, with a total trading volume of $501 million.

- On 24th February 2022, 23:18 (GMT+8), 4,192 lots were traded within one minute, with a total trading volume of $805 million.

- On 24th February 2022, 23:20 (GMT+8), 3,242 lots were traded instantly within one minute, with a total trading volume of $620 million.

Historically, war events have generally been accompanied by a rise in gold prices. Since the outbreak of the Russian-Ukrainian war in early February, the international gold price has risen by more than 15% in just one month’s time.

Due to the high-risk aversion in the international financial markets, spot gold touched $2073 on 8th March 2022, just $2 dollars away from spot gold’s all-time high of 2075.

Oil

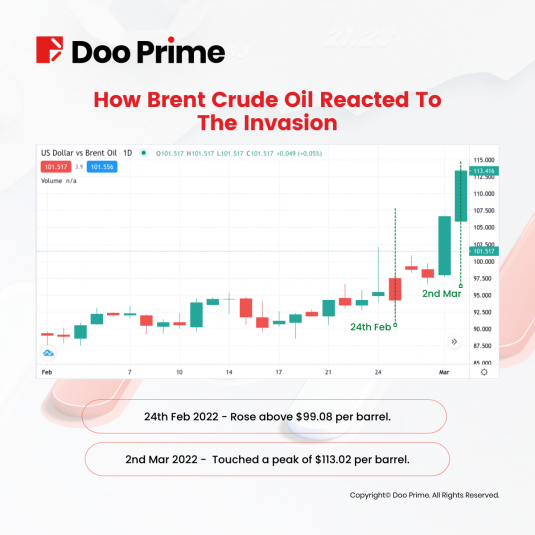

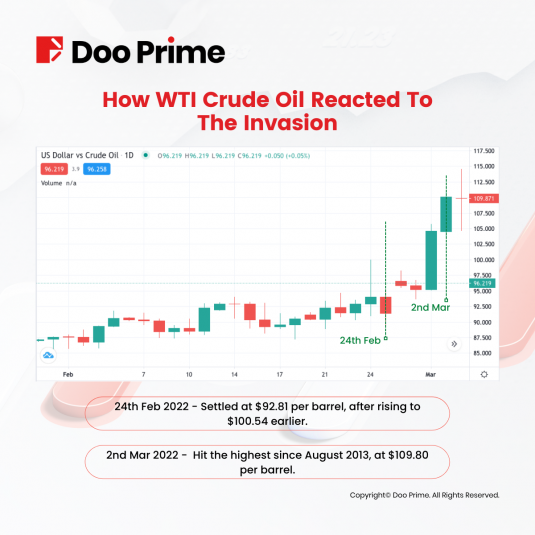

On the first day of the invasion, 24th February 2022, oil prices jumped, with Brent rising above $105 per barrel for the first time since 2014.

Global benchmark Brent crude rose $2.24, or 2.3%, to settle at $99.08 per barrel, after touching a high of $105.79. Meanwhile, U.S. West Texas Intermediate (WTI) crude rose 71 cents, or 0.8%, to settle at $92.81 per barrel, after earlier rising to $100.54.

Both Brent and WTI hit their highest levels since August and July 2014, respectively.

As a result, commodity currencies like the Australian dollar (AUD) and the New Zealand dollar (NZD) also surged.

On 2nd March 2022, oil spikes as supply disruptions mounted following sanctions on Russian banks, and traders scrambled to seek alternative oil sources in an already tight market.

Brent crude oil futures rose by more than $8, touching a peak of $113.02 per barrel, the highest since June 2014, before easing to $111.53, up by $6.56 or 6.3%.

U.S. West Texas Intermediate (WTI) crude futures also jumped more than $8 per barrel, hitting the highest since August 2013 before losing some steam to trade up to $6.39 or 6.2% to $109.80 per barrel.

This is just the tip of the iceberg of how the invasion is affecting the markets and trade industries around the world. Tune in to our next post to see how the Oil & Gas sanctions can influence your trades.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as an investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future results. Doo Prime makes no representation and warranties to the information displayed and shall not be liable for any direct or indirect loss or damages as a result of any inaccuracies and incompleteness of the information provided. Doo Prime shall not be liable for any loss or damages as a result of any direct or indirect trading risks, profit, or loss associated with any individual’s investment.