Doo Prime officially increased the leverage option from 1:500 to 1:1000 for all account types on 19th November 2022. The adjustment offers more flexible options, providing global clients the opportunity to leverage higher potential profits with less capital and further expand their investment opportunities.

*Note: Please see Leverage Adjustment Details Below.

Details Of The Leverage Adjustment

Adjustment Time: 00:00 on 19th November 2022 (GMT+2)

Applicable Account Types: CENT Account, STP Standard Account and ECN Professional Account

Leverage Adjustment Details:

Please be reminded that:

1.Before the release of major data or events, due to unpredictable market fluctuations, financial derivatives may generate large losses in a short period of time that exceed the investor’s initial investment. Therefore, in order to protect the vital interests of investors, clients may adjust their leverage at that time. Clients are advised to pay attention to the relevant notice.

2.Our company reserves the right to adjust the leverage if we find clients displaying any trading behavior that abuses leverage.

What Is Leverage?

Leverage is a powerful tool that allows traders to maximize their capital by expanding their exposure to the financial markets, at the same time investing less capital. By choosing the right leverage, you can start trading with a loan from a dealer by simply depositing much less margin than your exposure.

So, how does leverage trading work?

Before you start trading, you need to prepare an Initial Margin, which is the minimum margin required to open a position. When the number of positions remains the same, the greater the leverage used, the less the Used Margin per trade, and the more the Free Margin available. This helps you to counter greater risks.

Therefore, with the right use of leverage, you can not only start trading with less money, but also use the freed-up funds for more investments, which will increase the efficiency of capital utilization. On top of that, you can also use leverage to short the market when the market goes down.

In other words, leverage is able to amplify your available capital reserves. The more leverage you have, the more flexible capital you have!

Make Good Use of Leverage To Achieve Investment Flexibility

Now, Doo Prime offers up to 1000x leverage, giving you the flexibility to choose your leverage and open a full position with the appropriate margin to leverage more potential profits than if you were trading without leverage.

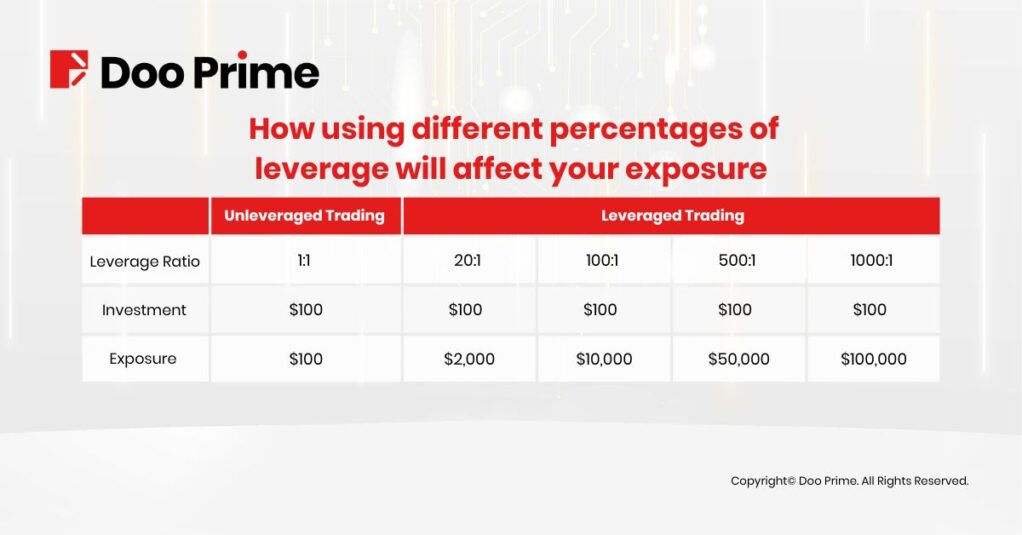

In unleveraged trading, USD1 can only trade the equivalent of USD1 in financial derivatives, while in leveraged investing, USD1 can trade more than USD1 worth of derivatives. For example, if you choose the maximum leverage of 1:1000, you can trade a financial asset with a nominal value of USD1,000 for only USD1. During this period, your investment gains or losses will be multiplied by this ratio.

Assumption: you choose to open a trade with 1000x leverage on Doo Prime with an exposure size of USD100,000, and you only need to invest US$100 margin to open the position.

Calculated as: USD100,000*(1/1000) = USD100

The following table shows how using different percentages of leverage will affect your exposure when the initial investment is USD100:

Do note that while leverage can lead to greater losses alongside magnifying profits, there are a variety of risk management tools that can help you reduce potential losses, including:

1. Stop Loss

With a guaranteed stop loss and a basic stop loss, you can pay a small premium for 100% stop loss protection even if there is a gap or slippage.

2. Take Profit

Your position is automatically closed when the price you specify is reached, thus your profit is secured regardless of market conditions.

3. Negative Balance Protection

If your account equity goes negative due to market fluctuations, Doo Prime will cover the negative portion of the loss so that your maximum loss is limited to the amount of the total assets initially invested.

Most importantly, traders should be clear that leverage is only a trading tool and that the amount of leverage does not affect the risk level of the investment, but rather the resulting gains or losses depend on the trader’s own knowledge and trading strategy.

| About Doo Prime

Doo Prime is an international pre-eminent online broker under Doo Group, which strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 90,000 clients, with an average trading volume of more than USD51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 10 different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe : +44 11 3733 5199

Asia : +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China : +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.