US stocks closed higher on Wednesday. The US Department of Labor revised down the total nonfarm employment for the year ending in March by 818,000 jobs.

The Federal Reserve’s meeting minutes revealed a strong inclination among policymakers to cut interest rates in September, with some participants suggesting a rate cut should have happened in July.

In addition to awaiting the Fed’s July meeting minutes, Wall Street is also eagerly anticipating comments from Federal Reserve Chair Jerome Powell. Powell is scheduled to speak at the Jackson Hole Economic Symposium on Friday, where he may provide further insights into the Fed’s next rate decision at the September meeting.

Jack Janasiewicz, Chief Portfolio Strategist at Natixis Investment Management Solutions, noted, “For us, the key will be the tone of Chair Powell. We expect his tone to lean dovish. Simply put, inflation continues to move toward the 2% target at a pace that seems faster than consensus. Combine this with signs of a weakening labor market, and it feels like there’s little need to maintain a hawkish stance.”

US Stocks

Fundamental Analysis:

Most major tech stocks rose, with Meta up more than 1%, and Tesla and Nvidia gaining nearly 1%, while Google dipped close to 1%. The apparel retail, scientific instruments, and metal fabrication sectors led gains, with Ross Stores and Gap up over 4%, and MKS Instruments rising more than 3%.

Meanwhile, the department stores, oil and gas exploration, and precious metals sectors lagged, with Macy’s dropping nearly 13%, and Century Aluminum and Nordstrom falling over 3%.

Most popular Chinese stocks rallied, with the Nasdaq Golden Dragon China Index rising 2.39%. Vipshop surged over 9%, while Futu Holdings, XPeng, and Li Auto climbed more than 4%. NIO and Alibaba rose more than 3%, and NetEase, Full Truck Alliance, and Baidu gained over 2%. Weibo increased by over 1%, while Tencent Music, Bilibili, and iQIYI posted smaller gains. JD.com fell over 4%.

Technical Analysis:

Market Trends:

- The Dow Jones rose 55.52 points, or 0.14%, to close at 40,890.49 points.

- The Nasdaq gained 102.05 points, or 0.57%, closing at 17,918.99 points.

- The S&P 500 Index increased by 23.73 points to close at 5,597.12 points, a rise of 0.20%.

Hong Kong Stock Market

Fundamental Analysis:

Hong Kong’s major indices rebounded after early losses. Tech stocks generally advanced, with Xiaomi surging more than 8% following its earnings report. JD.com gained nearly 2%, and Baidu and NetEase rose over 1%, while Meituan slipped more than 1%.

Insurance stocks were among the top gainers, with AIA rising nearly 5%. Pharmaceutical outsourcing stocks saw notable declines, and real estate developers also traded lower, with Longfor Group falling over 6%. Additionally, penny stock Greater China Financial plummeted 87%, closing at just HK$0.01.

Xiaomi’s earnings report drove its stock up over 8%. The company reported second-quarter revenue of RMB 88.887 billion, up 32.0% year-over-year, with adjusted net profit of RMB 6.175 billion, a year-over-year increase of 20.1%.

Technical Analysis:

Market Trends:

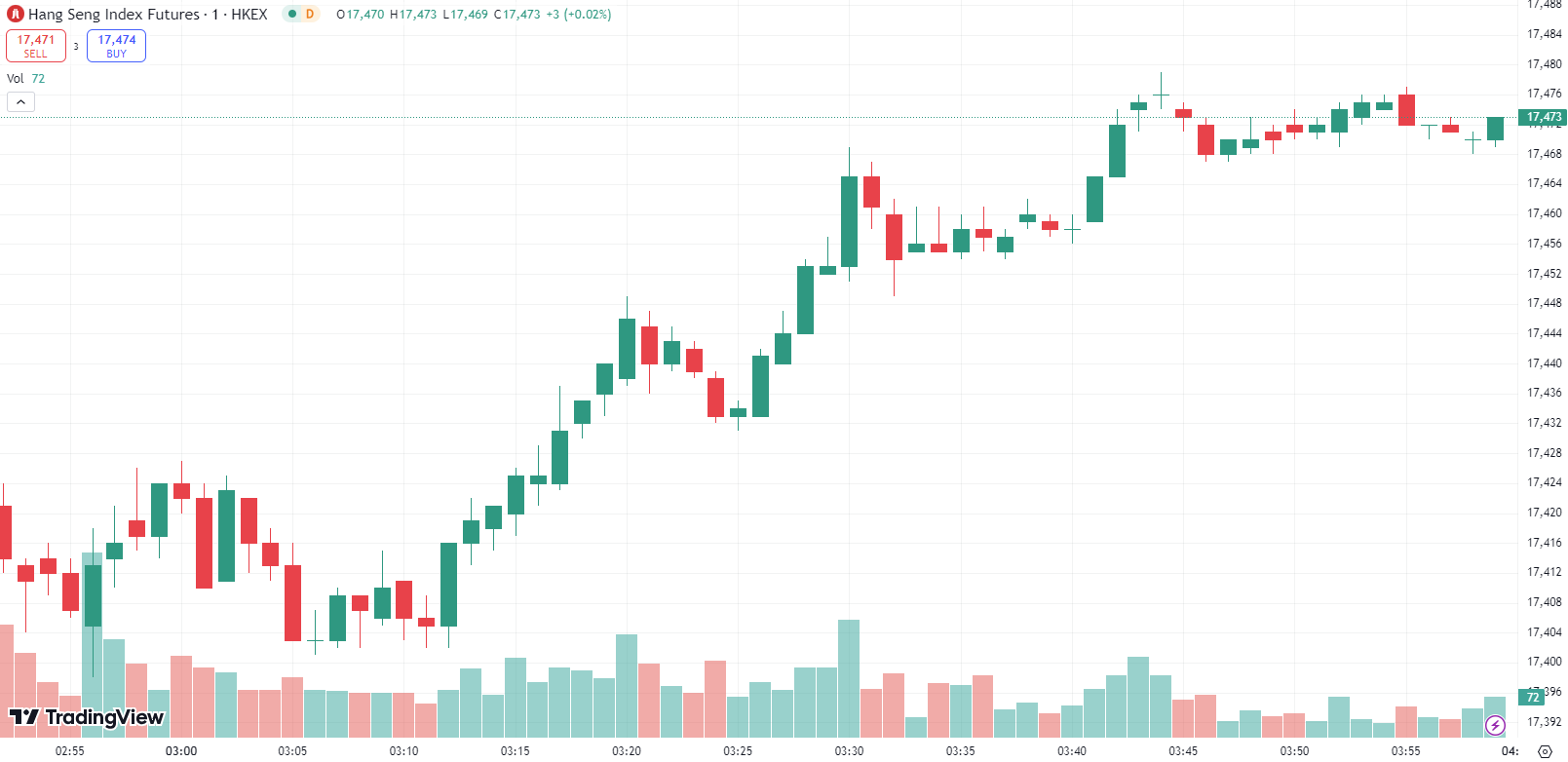

- The Hang Seng Index rose 0.40%, closing at 17,460.54 points.

- The Hang Seng Tech Index climbed 0.80%, ending at 3,461.84 points.

- The China Enterprises Index gained 0.21%, closing at 6,154.45 points.

FTSE China A50 Index

Fundamental Analysis:

China’s A-shares showed mixed performance, with the Shenzhen Component Index falling 0.48% by midday, despite several bank stocks hitting new highs.

The gaming, media, and cinema sectors saw significant declines, while large-cap consumer stocks such as liquor were also weak. Bank stocks provided some support to the market, and solid-state batteries and commercial aerospace sectors showed notable activity.

Technical Analysis:

Market Trends:

- The Shanghai Composite Index fell 0.04% to close at 2,855.56 points.

- The Shenzhen Component Index dropped 0.48% to 8,189.84 points.

- The ChiNext Index fell 0.48% to close at 1,550.98 points.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above strategies reflect only the analysts’ opinions and are for reference only. They should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.