China’s Country Garden Signals Default

China’s Country Garden Holdings (2007.HK) said it might not be able to meet all of its offshore payment obligations when due or within the relevant grace periods, as the country’s largest private property developer grapples with debt restructuring.

S. Korean Firm Gets Indefinite Waiver On Chip Supplies

Samsung Electronics (005930.KS) and SK Hynix (000660.KS) will be allowed to supply U.S. chip equipment to their China factories indefinitely without separate U.S. approvals, South Korea’s presidential office and the companies said yesterday.

Russian Rouble Experiences Rebound

The rouble rebounded after slumping to a more than 18-month low against the dollar yesterday in a volatile session, still hampered by reduced foreign currency supply but eventually latching on to higher oil prices to gain ground.

Today’s News

Asian shares are on the rise while Treasuries jumped following dovish comments on rates from Fed officials. Stocks in Australia, Japan and South Korea all rose over 1%. Futures in Hong Kong also pointed to gains. Contracts of U.S. stocks barely edged in the early hours in Asia after the S&P 500 advanced by 0.6% yesterday.

Treasuries jumped at the open as trading resumed after a holiday with yields experiencing a decline, including the likes of Australian and New Zealand bonds.

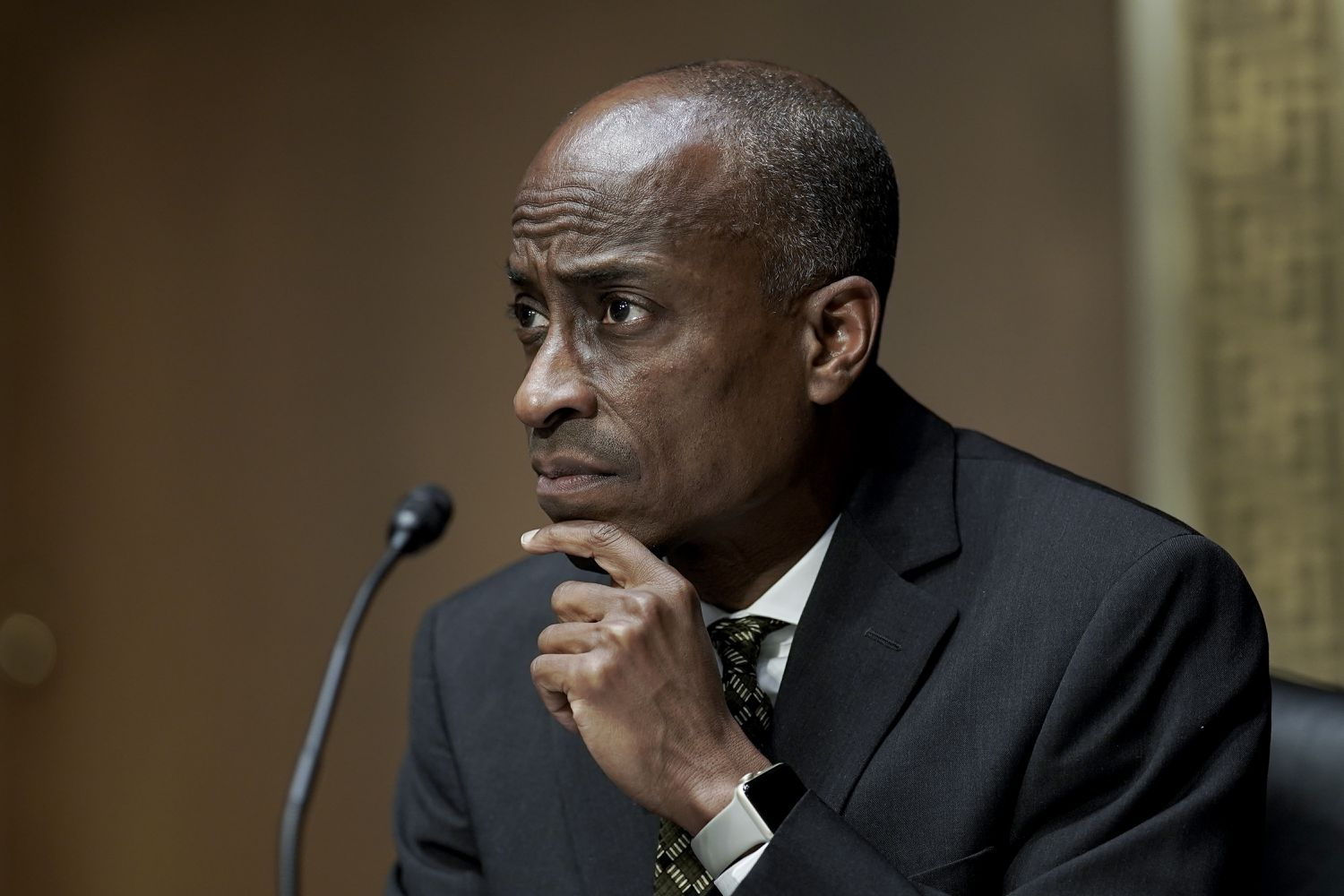

Fed Vice Chair Philip Jefferson said officials could “proceed carefully” following the recent rise in Treasury yields, and Fed Bank of Dallas President Lorie Logan said the surge in long-term rates may mean less need for further tightening.

At the end of last week, traders had boosted bets on another Fed hike this year as data indicated U.S. employment unexpectedly surged in September. That narrative was switched yesterday as central bank officials damped down speculation of another rate increase in 2023.

Other related news include:

Treasuries Jump On Dovish Fed Comments

Treasuries jumped the most since March after Fed officials made dovish comments as conflicts in the Middle East fueled a flight to safe-haven assets.

Yields on U.S. 10-year notes fell as much as 18 basis points to 4.62% as the cash market reopened following a U.S. holiday yesterday. Two-year yields slipped by a total of 16 basis points to 4.93% as investors boosted bets the Fed will keep interest rates unchanged through the end of the year.

Fed Officials Flag Tighter Financial Conditions

Top Federal Reserve officials are coalescing around the idea that tighter financial conditions after a recent surge in U.S. Treasury yields may substitute for additional increases in their benchmark interest rate.

Fed Vice Chair Philip Jefferson on Monday told a conference that he would “remain cognizant of the tightening in financial conditions through higher bond yields” in assessing “the future path of policy,” echoing similar comments from other policymakers.

Dollar Slips After Dovish Comments

The dollar softened today along with U.S. interest rate expectations and a fall in Treasury yields as investors detected a slight dovish shift in Federal Reserve officials’ tone.

The yen held small gains as violence in the Middle East supported the buying of safe-haven assets, and last traded firmly at 148.34 per dollar. The Swiss franc has also gained and was edging higher at 0.9045 to the dollar.