Today’s News

Nvidia’s shares soared again on Tuesday, continuing their significant recent gains on an otherwise subdued day for the stock market.

Image Source: Reuters

This surge followed another impressive earnings report from last week. On the back of this news, Nvidia’s stock ascended by 7%, bringing its gains to 32% for the month and a remarkable 130% for the year.

The excitement around artificial intelligence investments was further fueled when Elon Musk’s xAI secured USD 6 billion in private financing. This news provided an additional uplift to Nvidia’s valuation, underscoring the intense focus on AI that has propelled the chipmaker to new market heights.

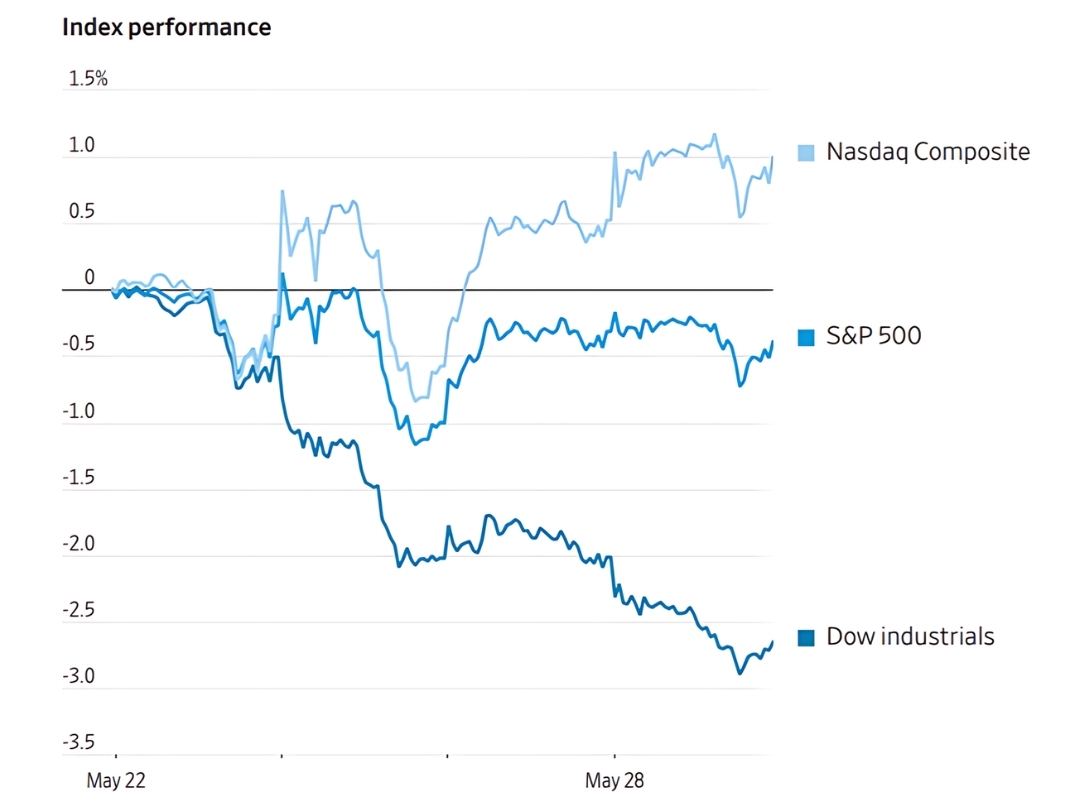

Other semiconductor stocks also experienced gains, contributing to a 0.6% rise in the tech-heavy Nasdaq Composite. Meanwhile, the S&P 500 saw a modest increase of less than 0.1%, and the Dow Jones Industrial Average fell by 0.6%.

Ed Clissold, chief U.S. strategist at Ned Davis Research, commented on the market’s reaction, noting that overall, investors are “digesting what was a pretty good earnings season.”

According to FactSet, with most S&P 500 companies having reported their first-quarter results, earnings are projected to have increased by 6% from the previous year—the most substantial rise since the first quarter of 2022.

Image Source: FactSet

Image Source: Reuters

In addition to robust earnings, several companies have announced stock buybacks or increased dividends, reflecting their strong and confident financial outlooks.

Conversely, the broader market felt pressure from a significant uptick in U.S. Treasury yields, which rose after consumer confidence reported higher than anticipated. The benchmark yield settled at 4.542%, up from 4.471% on Friday. This increase in yields, which happens when bond prices decrease, was exacerbated by weaker-than-expected demand at the auctions for 2-year and 5-year Treasury notes.

Higher yields can negatively impact stocks by raising borrowing costs across the economy and offering more competitive risk-free returns for investors holding Treasurys until maturity.

Dave Grecsek, managing director in investment strategy and research at Aspiriant, voiced concerns about the current yield levels, saying, “With yields at their current levels, you’re getting into the caution zone for stocks.”

Despite these challenges, the S&P 500 has still managed to gain 11% this year and 5.4% this month, rebounding from a 4.2% decline in April when concerns about inflation were more pronounced.

Other News

Vatican Enhances Anti-Money Laundering Efforts

The Vatican has significantly improved its measures against money laundering, according to a European financial watchdog, Moneyval. Following past financial scandals, it has revamped banking compliance and increased transparency.

JPMorgan Building Explosion at Youngstown, Ohio

An explosion at a JPMorgan Chase building in Youngstown, Ohio has prompted immediate safety checks and damage assessments, as confirmed by a company spokesperson. The bank is coordinating closely with local authorities.

Ex-FTX Exec Salame Receives 7.5-Year Sentence

Former FTX co-CEO Ryan Salame has been sentenced to 7.5 years in prison for making illegal U.S. political donations and operating an unlicensed money transmitting business, as part of the broader FTX financial fraud scandal.

Home

Home