Today’s News

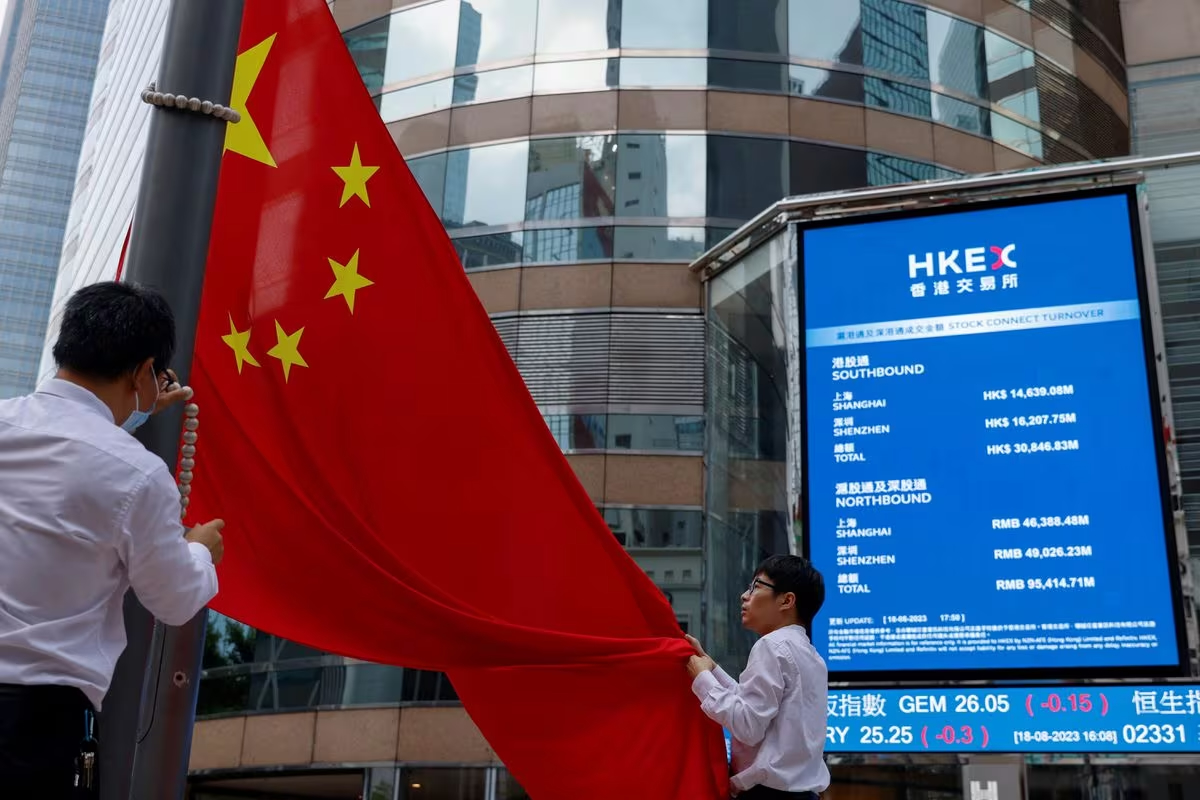

Image Source: Reuters

As Chinese stocks experience a relief rally in anticipation of the New Year holiday, market observers eagerly await Thursday’s release of the latest inflation figures, a critical determinant of whether the economy is making headway in breaking free from the clutches of deflation.

Forecasts, however, present a mixed narrative. Year-on-year consumer price deflation is anticipated to have deepened in January, while month-over-month prices surged at the fastest pace in a year. Concurrently, annual producer price deflation remains resilient, underscoring the complex challenges inherent in China’s battle against deflation. This struggle mirrors the economy’s uneven recovery from the pandemic, challenges in the property sector, heightened debt levels, and the downturn in asset markets.

The 6% drop in U.S.-listed Alibaba shares on Wednesday, following the company’s third-quarter revenue miss, might cast a shadow on Thursday’s market opening. If China’s inflation figures confirm persistent downward price pressures, concerns about the global exportation of deflation could intensify, presenting a complex scenario for U.S. Federal Reserve policymakers and their counterparts worldwide.

Despite these concerns, global stock markets appear undeterred. The MSCI world index reached a two-year high, the S&P 500 attained a record peak approaching 5000 points, and the MSCI index of developed market stocks also set a new record.

In the wake of Wednesday’s guidance from three Fed officials, suggesting a stance against the 120 basis points of rate cuts priced into rates futures markets, bond yields and the dollar edged lower post a 10-year U.S. bond auction. The auction, involving the sale of USD 42 billion of debt, marked one of the largest 10-year sales on record, with demand proving robust.

Shifting attention to India, the Reserve Bank is poised to announce its latest interest rate decision on Thursday. Expectations lean towards the maintenance of the repo rate at 6.50%, a level unchanged for a year and likely to persist until the second half of this year. Despite this, money market pricing hints at the potential for the first and only rate cut later in the year, positioning the RBI as one of the less dovish central banks. This dynamic helps explain the slight rise of the rupee against the U.S. dollar, albeit from a record low base, plummeting to 83.50 per dollar late last year.

Key developments shaping Thursday’s market direction include China’s consumer and producer price inflation data for January, India’s interest rate decision, and Japan’s trade and current account figures for December.

Other News

Arm’s Shares Surge 20% On AI Demand Boost

U.K. chip designer Arm witnesses a remarkable 20% surge in shares after reporting increased royalty and licensing revenue, driven by strong demand for artificial intelligence applications. The optimistic outlook prompts a significant upward revision in full-year revenue guidance.

Deloitte Plans 100 More Job Cuts In The U.K.

Deloitte is set to cut 100 jobs in the U.K., primarily from its corporate finance advisory business, as prolonged deals inactivity continues to impact demand. This follows the 700 redundancies announced in September, reflecting a tougher economic environment.

Call For Post-Brexit Superwatchdog On U.K. Regulators

A House of Lords report recommends the creation of a superwatchdog in the post-Brexit era to enhance accountability for regulators, addressing concerns over their independence and potential politicization.