Chip stocks have faced significant declines recently, largely driven by geopolitical tensions and political statements from former U.S. President Donald Trump. Shares of leading semiconductor and related tech companies such as ASML, Nvidia, and TSMC have been hit hard by Trump’s calls for Taiwan to pay for U.S. protection and reports of potential export restrictions from the Biden administration.

Trump’s Comments and Market Reaction

The catalyst for this market movement was Trump’s assertion that Taiwan, which is central to the global semiconductor industry, should finance its own defense against China. In an interview on June 25 that was published on Tuesday, Trump stated, “I know the people very well, respect them greatly. They did take about 100% of our chip business. I think Taiwan should pay us for defense. You know, we’re no different than an insurance company. Taiwan doesn’t give us anything.”

These remarks, suggesting that the U.S. is acting as Taiwan’s “insurance” without adequate compensation, have added to the geopolitical uncertainty. As a result, semiconductor stocks, including TSMC, ASML, and Nvidia, have experienced notable declines.

Biden Administration’s Potential Export Restrictions

In addition to Trump’s comments, the market was further unsettled by reports that the Biden administration is considering the strictest controls on the trade of chips to China. According to a Bloomberg News report, the U.S. is contemplating the use of the Foreign Direct Product Rule (FDPR), a severe trade restriction, to prevent companies from providing advanced semiconductor technology to China. The FDPR, first introduced in 1959, allows the U.S. government to control products made using American technology, even if produced in foreign countries.

These measures could significantly impact companies like Tokyo Electron and ASML, which manufacture critical semiconductor production equipment. The U.S. is presenting this idea to officials in Tokyo and The Hague, emphasizing that such measures might become necessary if these countries do not tighten their own trade restrictions with China.

Despite President Biden dropping out of the re-election race, he will remain in office until the end of his term. So, any trade restrictions or policies will remain in effect.

Market Impact on Key Players

The combined effect of Trump’s comments and the potential new regulations has led to substantial drops in stock prices:

- TSMC fell by 2.4% on Thursday, following a 7% drop the previous day.

- ASML shares declined by a further 2% in early Thursday trading, after an 11% plunge on Wednesday.

- Tokyo Electron and other Japanese semiconductor-related companies also saw significant declines, with Tokyo Electron’s shares falling by 8.8%.

In the U.S., the tech-heavy Nasdaq index closed 2.7% lower on Wednesday, while chip stocks have also tumbled in Europe and Asia. Nvidia closed 6.6% lower in New York on Wednesday, while AMD lost more than 10%.

Investment Perspective: A Buying Opportunity?

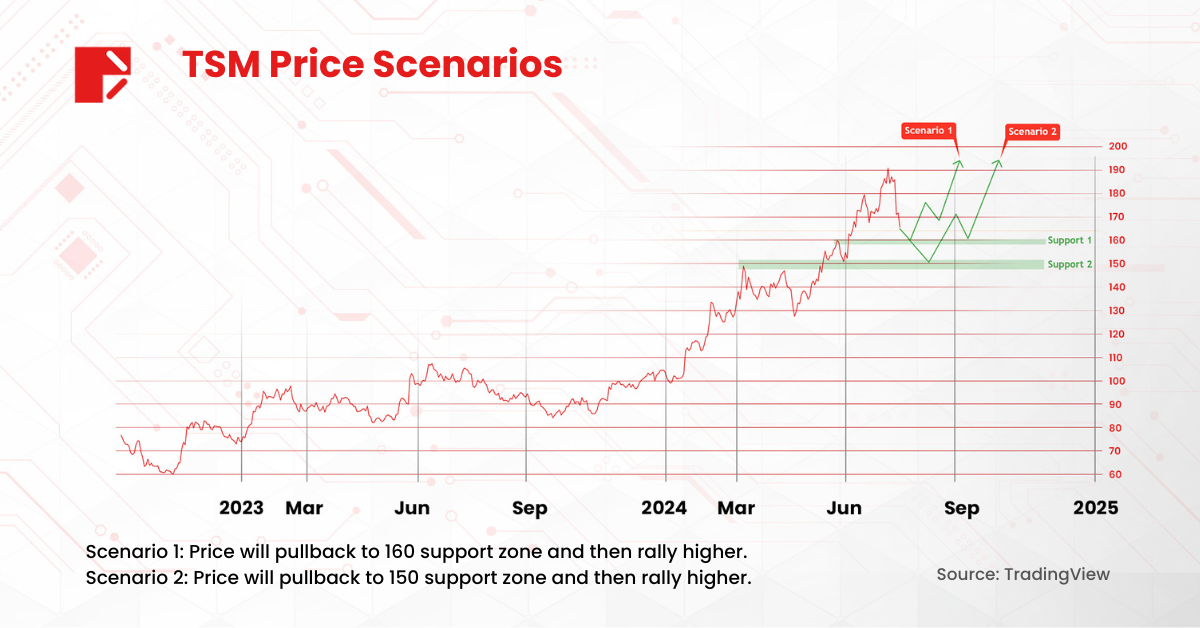

Image Source: Trading View

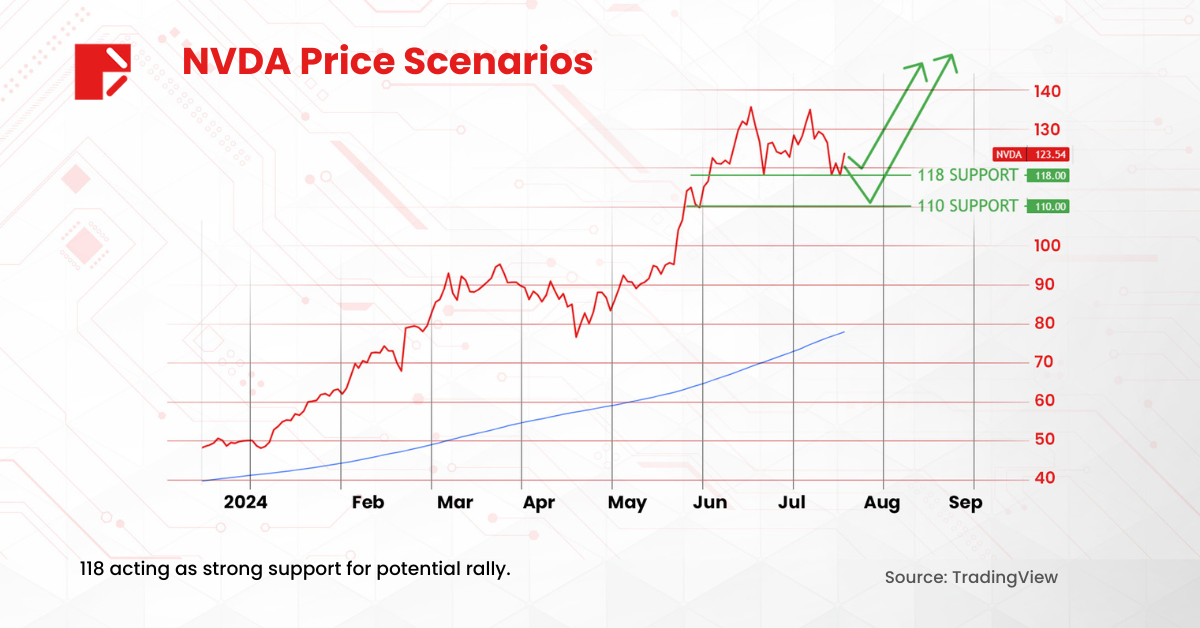

Image Source: TradingView

Despite the immediate market reaction, it’s essential to recognize that markets often exaggerate the impact of political news. While the current decline in chip stocks is notable, the overall market outlook for the semiconductor sector remains bullish. The fundamentals of companies like ASML, Nvidia, and TSMC are robust, and the demand for semiconductors continues to grow across various industries, from consumer electronics to automotive and artificial intelligence.

For traders and investors, this market dip could present a unique buying opportunity. The current lower prices offer a chance to invest in high-quality chip stocks at a discount. Historically, periods of market turbulence have often been followed by strong recoveries, particularly in sectors with solid growth prospects like semiconductors.

All in all, while geopolitical tensions and political statements have contributed to the recent decline in global chip stocks, the long-term outlook for the semiconductor industry remains bullish. Investors should consider the current market conditions as a potential buying opportunity rather than a reason for fear. With the continued growth in demand for advanced technologies, the semiconductor sector is well positioned for future gains.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.

Home

Home